Glassnode, an on-chain analysis firm, has stated that $136,000 may be the next important price for Bitcoin if its current momentum is maintained.

Bitcoin’s Short-Term Holding Cost Basis is Set at $136,000

It’s a brand new world thread Glassnode, on X has shared what a couple of on-chain indicators indicate about the state of Bitcoin in this cycle. The analytics company shared the first metric. Short-Term Holder (STH) Cost BasisThis measure measures the average purchase price of investors who bought their coins during the previous 155-day period.

Read Related Articles

The chart below shows the trends in this metric for the past two years.

According to the graph displayed, Bitcoin’s price rose above STH Cost Basis in early 2014 and has been above that line ever since. This indicates STHs are in net profit.

The same chart shows a number of other levels that correspond to different standard deviations (SDs) from STH Cost Basis. Recent price increases have pushed the STH Cost Basis to new heights. all-time high (ATH) BTC’s price surpassed the level of +1 SD, historically a sign of a hot market.

The coin returned to its original position after the initial pullback. However, it is still very close. “If this momentum continues, the next key level is $136k (2 +std), a zone that has historically marked elevated profit-taking and local market peaks,” Glassnode explained

Bitcoin may not be overheated in the STH Cost Basis Model, but other indicators show a very different story. STH Supply In ProfitA recent indicator, which tracks how much of a cohort’s stock is in a positive state, has soared above 88%, the level that marks the end of high-risk and euphoric stages.

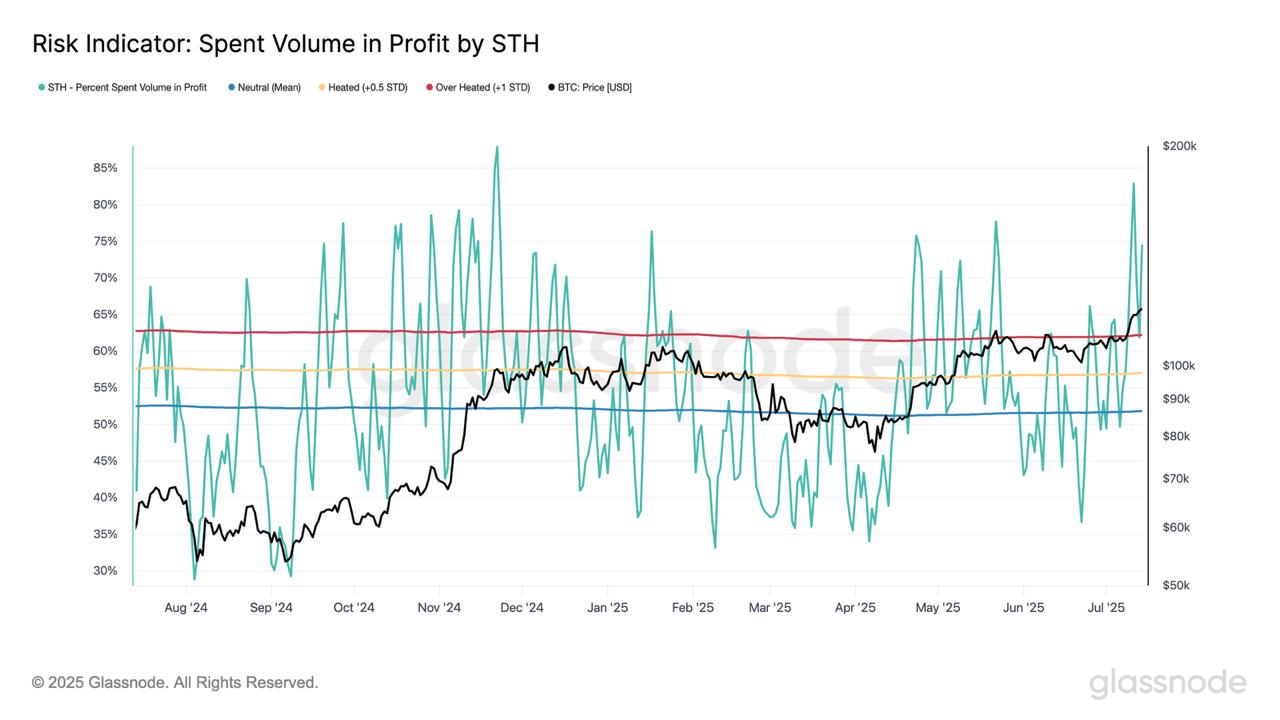

The percentage of STH volumes that lead to profits was another similar metric which saw an increase above the historically overheated threshold of 62%.

“Such spikes often occur multiple times in bull markets, but repeated signals at these levels typically precede local tops and warrant caution,” Notes the Analytics firm.

During this period of increased profit-taking the Bitcoin STHs realized a ratio between profit and loss of 39.8. This is based on a seven-day exponential-moving-average (EMA).

Again, the value is extreme compared to historical norms. This is a value that’s, once again, extreme by historical standards.

Read Related Articles

“Historically, cycle tops follow with a lag, leaving room for further upside,” Glassnode. “However, risk is elevated and the market becomes increasingly sensitive to external shocks. The current pullback aligns with this pattern.”

BTC Price

Bitcoin has risen by more than 8 percent in the past seven days.

Featured Image: Dall-E. Glassnode.com. Chart by TradingView.com

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com