The key takeaways

-

Bitcoin price speculation is fueled by the accumulation of BTC in corporate BTC and strong Bitcoin miners.

-

BTC could not reach new heights due to the rising expectations of inflation among investors and the weakened consumer sentiment.

BitcoinBTC) climbed above $116,000 on Friday, fueled by a fresh S&P 500 all-time high and growing expectations of a more accommodative monetary stance from the United States Federal Reserve. The accumulation patterns of miners are a similar signal to that which preceded the 48% rise in price for bitcoins back in 2023. This is giving Bitcoin bulls confidence.

Data from GlassNode shows miners’ wallets added positions for the third straight week, with net inflows peaking at 573 BTC per day on Tuesday — the highest level since late October 2023. The strong accumulation of last year led to a 48% increase in early December. It prompted traders to question whether the run towards $150,000 was possible again.

BitcoinTreasuries.NET. BitcoinTreasuries.NET data The top 100 public companies’ reserves surpassed 1 million BTC First time this September.

Bitcoin continues to be accumulated by miners and businesses despite growth concerns

Despite missing potential inclusion in the S&P 500 index, Michael Saylor’s Strategy disclosed an additional $220 million Bitcoin purchases were reported in Monday’s filing with the Securities and Exchange Commission. Its market capitalization of $95 Billion places the company among the largest listed US firms, surpassing Moody’s Corp. General Dynamics and Dell Technologies.

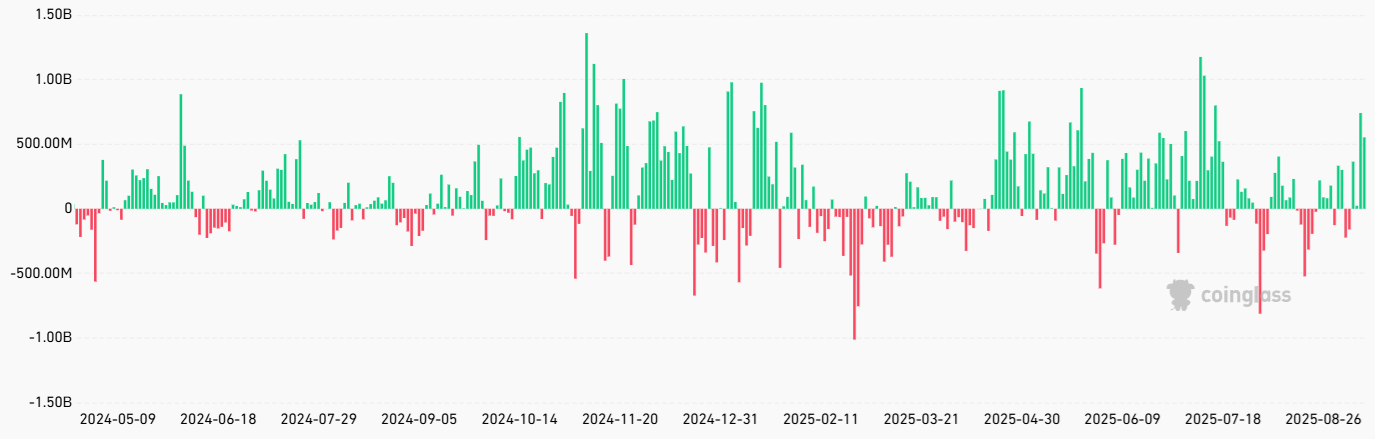

US-listed Bitcoin ETFs are added $1.3 billion in inflows Between Wednesday and Thursday the total asset under management reached $148 billion. iShares Bitcoin Trust is the leader, with $87.5 Billion. Fidelity’s Wise Original Bitcoin Fund (FBTC), at 23 billion dollars and Grayscale Bitcoin Trust at 20.6 billion dollars are next.

World Gold Council estimates that the global gold market is worth $24.7 trillion. data. Bitcoin ETFs are a reflection of the Bitcoin industry even when you take out jewelry demand, which accounts for nearly half. deeper penetration The market capitalization of the company is $2.3 trillion, and it has only been launched in 2024.

Related: All roads lead to inflation–Fed cut or not, Bitcoin may stand to gain

Bitcoin’s trajectory towards $140,000, even with traders pricing in 75% of the price, is not guaranteed. odds US interest rates will fall below 3.5% at the end of 2025. On Friday, the University of Michigan consumer survey showed that confidence had declined by more than anticipated in September. However, long-term inflation expectations rose to 3.9% due to concerns about tariffs.

The continued Bitcoin acquisition by miners and companies sets the tone for a bullish market, however fears about sluggish economic growth may cause traders to be more cautious in approaching future weeks.

The article does not provide legal advice or investment recommendations and it is intended for informational purposes only. These are solely the opinions, views, and thoughts of the author and may not reflect the opinions and views of Cointelegraph.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com