Bitcoin’s long-term investors have recently seen their spending increase, with Friday seeing the highest daily surge of the year.

Bitcoin investors aged between 1 and 2 years old accounted for the largest part of the spike.

The new post Glassnode’s on-chain analytics company, Glassnode discussed the Bitcoin transaction activity on the X. long-term holders (LTHs) Recently, someone has looked. LTHs are BTC holders who’ve held onto their coins longer than 155 consecutive days.

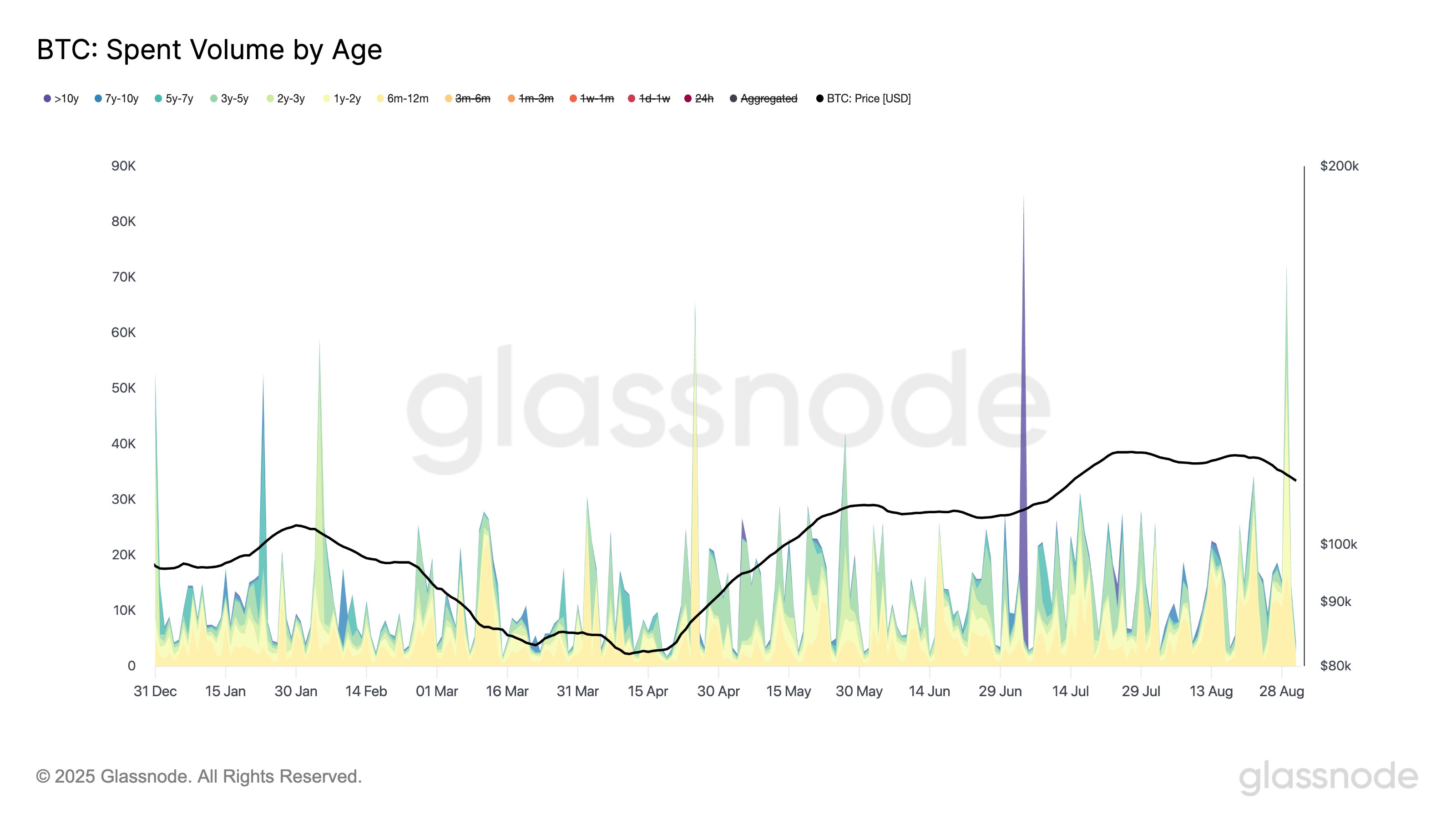

Statistically, an investor is less likely to be able to sell their coins in the future if they hold onto them for a longer period of time. LTHs, with their relatively longer holding times are seen as being resolute. Even though they are resolute, even this group of people will sometimes decide to sell their coins. Glassnode shared the chart below that shows spending by this cohort over the past 12 months.

In the graph below, you can see that the SMA of the Bitcoin spending by LTHs over the last 14 days has risen dramatically, indicating that HODLers will be increasing their activity.

After a spike in LTH expenditures, the increase has been attributed to a decline The BTC rate has increased. This could be an indication that diamond holders are thinking about the future. bull run They have taken their profit and left the market while it is still possible.

Although Bitcoin LTH is experiencing a surge in transactions, it’s still far below levels seen during the final quarter of the year 2024. Also, the smoothed data of the 14-day SMA may suggest the development corresponds to an increase in spending over a period, but it turns out that it’s largely due to a single large daily spike.

From the chart, it’s apparent that this large spike that occurred on Friday involved around 97,000 BTC, worth a whopping $10.6 billion. It’s the biggest spending day so far for LTHs.

The LTH group’s 155-day cutoff means that the cohort covers a rather large range, so here’s another chart, this one breaking down how the different segments of the group have contributed to this event:

This would suggest that Bitcoin LTHs older than 2 years contributed 34,500 BTC to the spike in spending. Segments such as the 3 to 5 year and 6 to 12 month segments also contributed 16,000 BTC each.

BTC Price

Bitcoin dropped towards $107,000 on the weekend. But it now appears that its value has recovered to $109,500 as of Monday.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com