The key takeaways

-

The US housing market and the exploding US Debt could cause a BTC Correction to $95,000.

-

Bitcoin’s value remains tightly tied to macro-trends, such as Fed policy and institutional flow.

On Monday, the United States reached a new high in gross national debt of $36.6 trillion. This surge was triggered by US President Donald Trump’s endorsement of the “One Big Beautiful Bill,” This raised the ceiling of debt by $5 trillion. This could be a trigger for Bitcoin?BTCWhat if you crash your car to $95k?

Kurt S. Altrichter CRPS, founder of Ivory Hill Wealth and other analysts have warned about a possible downturn in the US housing industry. Altrichter claims that an important metric, usually spiking during previous economic downturns, has reached alarming levels.

The supply of single-family houses is now approaching 10 months. Altrichter says that this is a 10-month supply. “has only occurred during or right before recessions.” He says that housing is weak because of high interest rate but also, and more importantly from what he terms “affordable” mortgages. “demand evaporation.”

If this historical pattern — linking housing oversupply to broader economic decline — holds true, the impact could weigh on risk-on assets, including Bitcoin. Although the effect on crypto may be positive in the long term, investors will tend to favor cash and bonds that are short-term.

Jack Mallers noted that on X the US Treasury had no viable alternative to Strike. expand the monetary base — an action akin to printing money. Mallers says that it is unlikely the government will print money. default on its debtDebasement is the last resort, he says. He suggests that this creates the perfect environment for Bitcoin to rally.

Bitcoin’s destiny depends on US Federal Reserve action

Some participants on the market have a different narrative: They say that Bitcoin’s recent breakout over $112,100 is not related to fears about fiscal matters or upcoming recessions. The stock market is attributed to expectations that the Federal Reserve will change its policy.

Trump’s possible push for a new replace Fed Chair Jerome Powell. The move, if successful, could result in a more dovish policy. Trump has repeatedly asked the Fed for a rate cut. Fox Business reported that Trump is currently interviewing candidates to replace Powell, whose tenure ends in 2026.

Although strong net inflows BTC, which is closely related to broader equity market due to its inclusion in Bitcoin ETFs and growing demand from institutions, remains tightly tied with the stock markets.

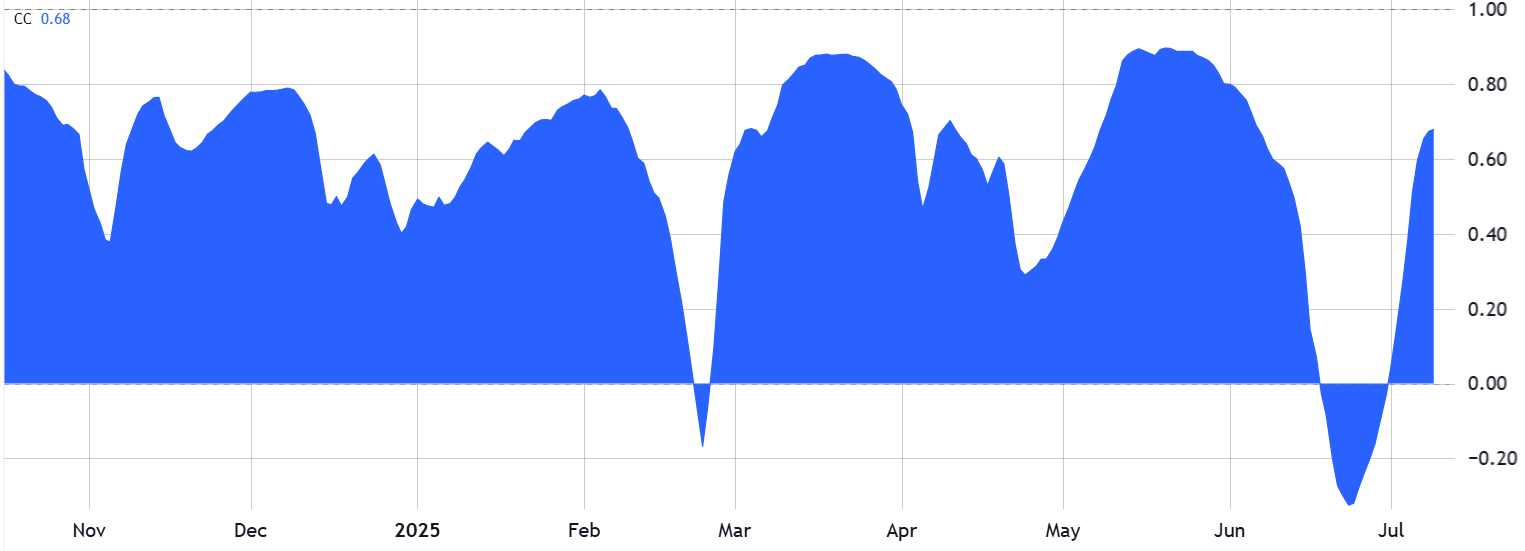

The correlation between Bitcoin and the S&P 500 stands at 68%, meaning both asset classes have presented similar price trends. US import duties are another factor that could hurt earnings for corporations, particularly in the tech industry, as it is highly dependent on international trade.

Related: Bitcoin data points to rally to $120K after pro BTC traders abandon their bearish bets

Nvidia, which on Wednesday became the most valuable company in the world with a market capitalization of $4 trillion, is particularly vulnerable. Escalating trade tensions could trigger a sharp decline in technology stocks, but it’s hard to say. Although raising the debt limit often encourages a risk-on attitude, a possible recession might cause Bitcoin’s price to fall as low as $95,000.

Jack Mallers, Strike, noted that a new Bitcoin high in 2025 is still plausible. Traders appear concerned about whether AI-driven tech will survive the trade dispute.

The article does not provide legal advice or investment recommendations and it is intended only for informational purposes. These are solely the opinions, views, and thoughts of the author and may not reflect the opinions and views of Cointelegraph.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com