BitcoinBTCAs traders prepared for liquidity grabs, the dollar was near its highest level of the year as it closed Sunday.

The following are key points.

-

Bitcoin is a classic example of a fake out as it closes on the same day that the US-Venezuela headlines are released.

-

BTC prices rose as much 2% this weekend. $92,000 is next in the list of bulls.

-

Bitcoin is trying to make a comeback, and it’s crunch time.

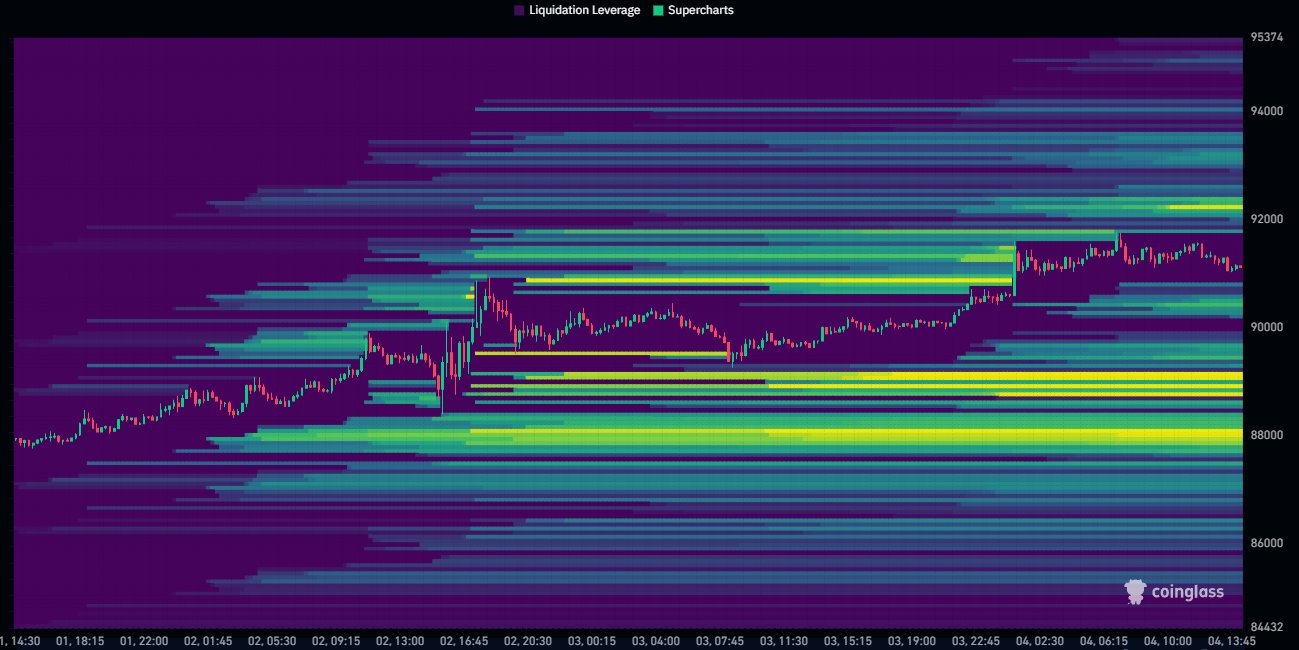

Bitcoins liquidations on the horizon as we approach weekly closing

Data from TradingView BTC/USD fluctuated above $91,000.

Over the weekend, the pair rose up to 2% as the crypto market offered its first reaction to the US military action in Venezuela.

Before TradFi returns, traders are looking at the liquidity of exchange order books to get a sense for where BTC prices might be headed in short-term.

“Largest liquidity cluster in close proximity sits below the yearly open around the $88K area,” Daan Crypto Trades explains in one his blogs: latest X posts CoinGlass, a monitoring tool.

“Above, the $92K level is the one to watch which is also in line with what has been roughly the range high for so long now.”

Exitpump also commented that orders books have been shifted. “thin air” above $95,000 — potentially providing the foundation for a quick retest of the $100,000 mark.

$BTC Look out for the largest selling walls of spot orderbooks at levels 92K, 94K and 95K.

Thinning air from 95K up to 100K pic.twitter.com/vZjwutyV4l

— exitpump (@exitpumpBTC) January 4, 2026

The following are some of the ways to get in touch with us. Cointelegraph reportedBTC’s price has been boosted by recent weekly candle closings “fakeouts” In both directions when the market fails to move beyond its local range but liquidates adjacent positions.

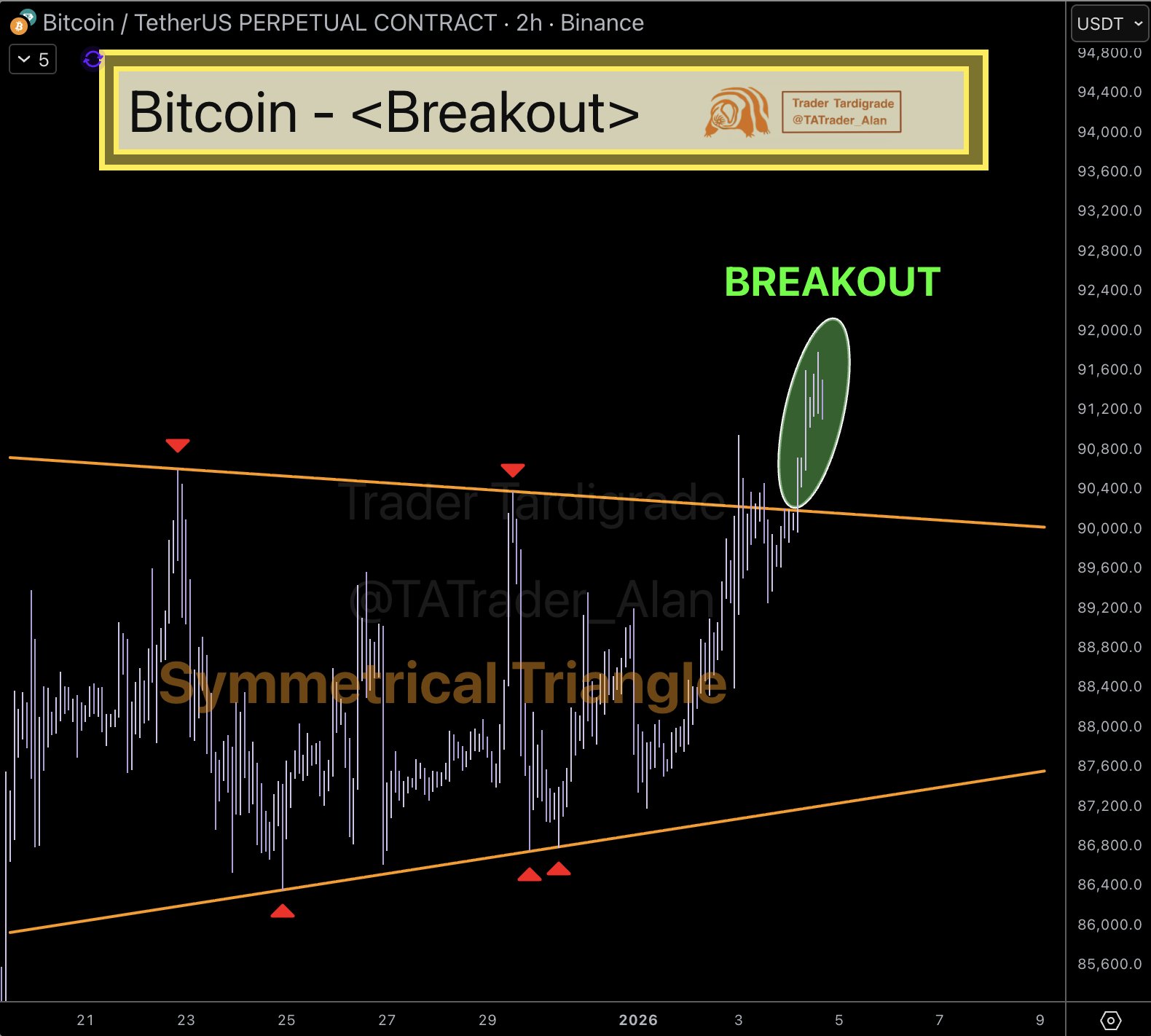

Alan Tardigrade hints that change is finally on its way reported BTC/USD has now broken out of a triangle formation on two-hour timespan. A chart with the accompanying data showed that $90,000.00 was the critical level.

Crypto set to join TradFi Venezuela

As futures prepare to open, the expectations for volatility on global markets have also been cemented.

Related: Bitcoin price back at $90K: Is the bear market behind us?

The Kobeissi Letter, a trading resource that warns readers about rocky future conditions, emphasized the importance of oil.

“This weekend’s events in Venezuela will have major effects on the global economy,” The conclusion of the argument was an X thread.

“The macroeconomy is shifting and stocks, commodities, bonds, and crypto will move.”

Kobeissi also added that Venezuelan gold reserves are the biggest in Latin America. This increased pressure on markets for gold, which already had flagged into the end of the year Crypto has recovered.

When everyone is focused solely on oil

Venezuela has 161 tons of gold in its reserves.

The 161 tonnes is about 5.18 millions troy ounces at $4.300/oz, which equals $22 billion.

Venezuela has the highest gold reserves in Latin America.

Every $100 that… pic.twitter.com/pI8DWgt1CB

— THe Kobeissi Letter (@KobeissiLetter) January 4, 2026

Commenting on Bitcoin’s perspectives versus the precious metal, crypto trader, analyst and entrepreneur Michaël van de Poppe was optimistic.

“$BTC vs. Gold is starting an uptrend,” he told X Followers on the Day

“It’s not confirmed yet, preferably you’d like to see an higher high to be established. That would confirm the bullish divergence. Other than that, it’s looking great on the markets.”

Van de Poppe pointed out that Bitcoin’s relative strength (weekly) index was (RSIThe values of the stock market had fallen to their lowest level since the bear market ended in 2022.

The article is not intended to provide investment advice. Each investment or trading decision involves risk. Readers should do their own research before making any decisions. Cointelegraph, while striving to give accurate information and in a timely manner, does not guarantee accuracy, completeness or reliability. This article might contain risky and uncertain forward-looking statements. Cointelegraph shall not be responsible for any damage or loss arising out of your reliance upon this information.

The article is not intended to provide investment advice. Each investment or trading decision involves risk. Readers should do their own research before making any decisions. Cointelegraph, while striving to give accurate information and in a timely manner, does not guarantee accuracy, completeness or reliability. This article might contain risky and uncertain forward-looking statements. Cointelegraph shall not be responsible for any damage or loss arising out of your reliance upon this information.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com