BitcoinBTCThe analysis of both assets describes them as “remarkably impressive.”

It is not a post on X On April 16, the popular trading and analysis account Cryptollica forecasted that BTC/USD would copy gold in the next few days, hitting new highs.

BTC Price Analysis: Key BTC Similarities to Gold

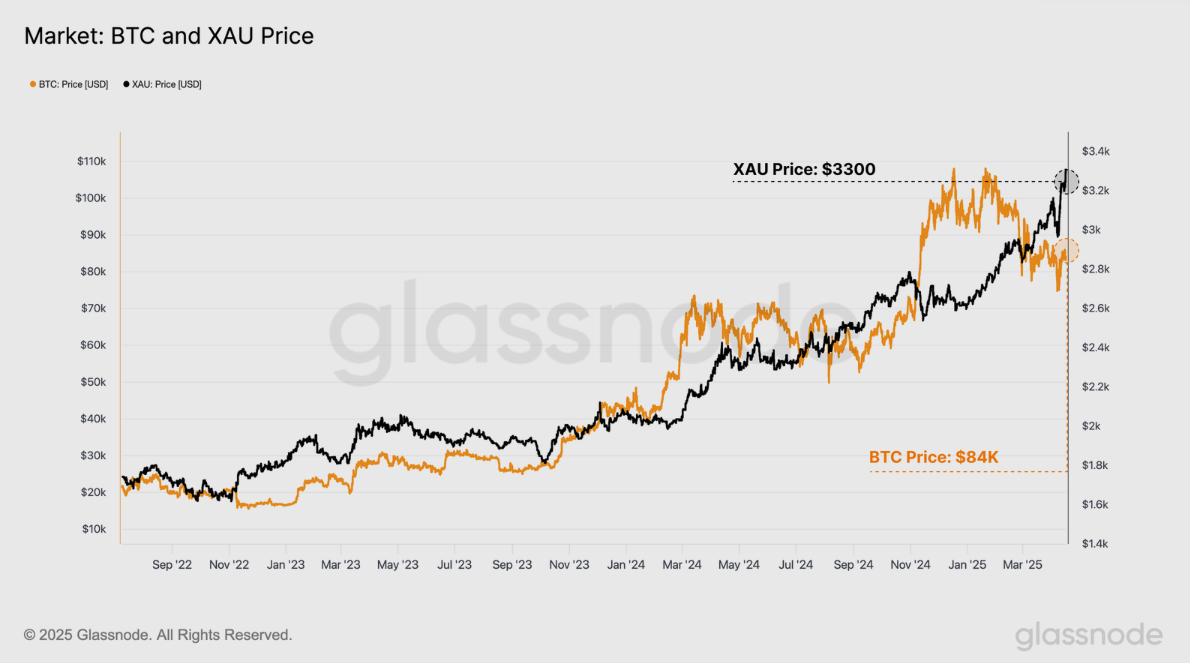

Bitcoin’s inability to catch up with gold and its record-breaking performance in 2025 has been the subject of headlines.

Data from the XAU/USD exchange rate shows that BTC/USD has fallen 9.3% in value year to date. Cointelegraph Markets Pro The following are some examples of how to get started: TradingView shows.

The despite calls for an imminent “blow-off top” Bitcoin bulls believe that gold will be available after several delays. “digital” The same will apply to the equivalent.

For Cryptollica, this means BTC/USD breaking out of a consolidatory wedge structure to swiftly reclaim six figures — and more.

“Bitcoin midterm target: 155K $,” It told X people.

BTC’s price has a number of potential tailwinds that have all fueled bull markets in the past.

You can also read about the advantages of using Cointelegraph reportedThis includes a falling US dollar index DXY and a record-high global money supply M2.

Bitcoin “remarkably impressive” Trade war

Glassnode, a firm that provides on-chain analysis, argues, “Despite the disparity in price performance, Bitcoin and Gold have fared remarkably well during the current macroeconomic crisis.”

Related: Can 3-month Bitcoin RSI highs counter bearish BTC price ‘seasonality?’

“Amidst this turmoil, the performance of hard assets remains remarkably impressive,” In the most recent edition of their regular newsletter “The Week OnchainPublished on April 16th.

“Gold continues to surge higher, having reached a new ATH of $3,300, as investors flee to the traditional safe haven asset. Bitcoin sold off to $75k initially alongside risk assets, but has since recovered the weeks gains, trading back up to $85k, now flat since this burst of volatility.”

Glassnode has said that BTC, gold and other digital currencies are all the same. “increasingly entering the centre stage as global neutral reserve assets.”

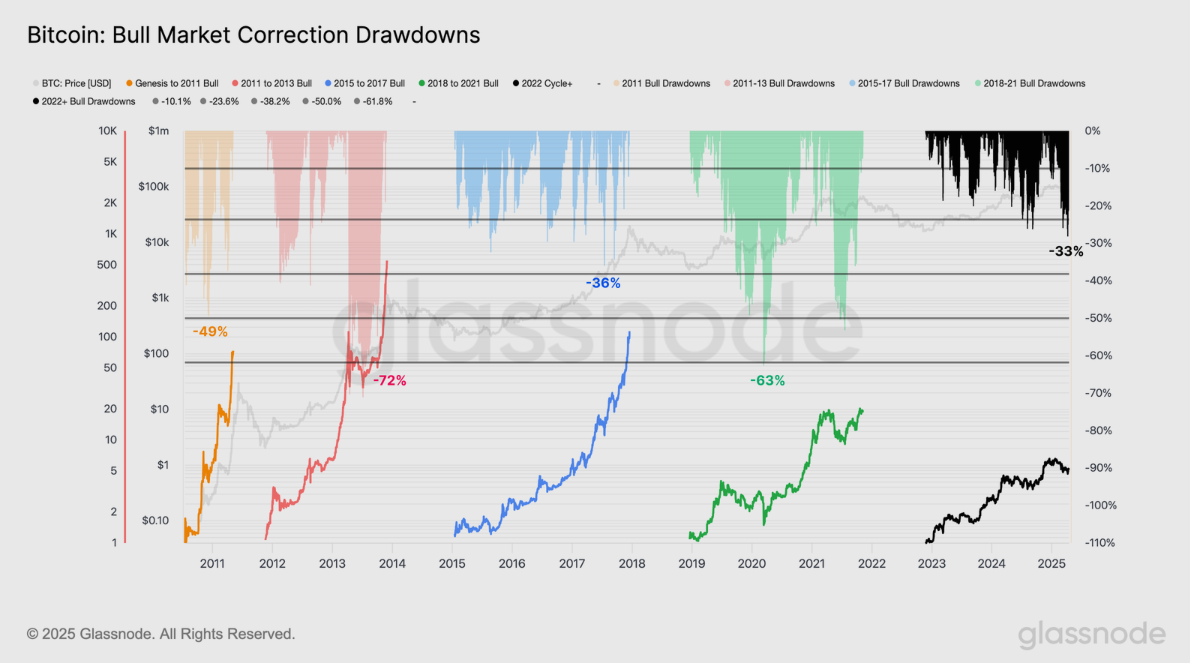

Analysts have stressed that the BTC drawdown is modest by historical standards. The dip from all-time highs to the current price remains at about 30%.

“In prior macroeconomic events like last week, Bitcoin has typically experienced greater than -50% sell-offs in such events, which highlights a degree of robustness of modern investor sentiment towards the asset during unfavourable conditions,” It is written as follows: ongoing US-China trade war.

The article is not intended to provide investment advice. Each investment or trading decision involves some risk. Readers should do their own research before making any decisions.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com