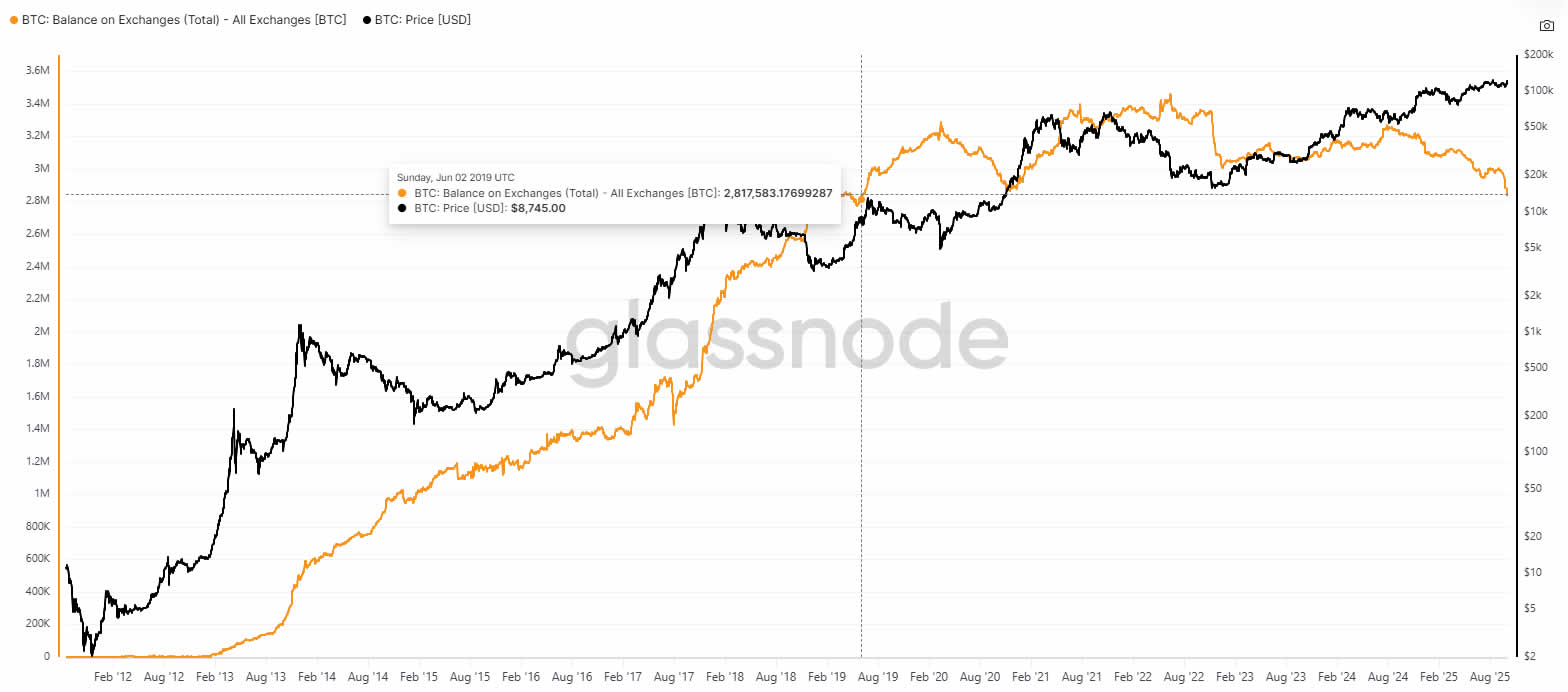

Bitcoin’s holdings on central exchanges have plummeted to their lowest level in six years, while the asset has risen to its highest point ever.

Bitcoin reached a new milestone all-time high Coinbase has reached $125,700 in the early hours of Sunday. according Tradingview is a great trading platform.

Coinbase reached a previous high of $124.500 on August 14. Bitcoin (BTCThe pound fell by 13% on Sept. 1, but recovered quickly over the last week. ‘Uptober’ began.

“Bitcoin hits new all-time high … And most people still don’t even know what Bitcoin is,” commented Nova Dius President Nate Geraci.

“If Bitcoin is able to convincingly break $126,500, then chances are price will go a lot higher and quickly,” said Rekt Captial analyst Rekt on Saturday morning, just before the price’s latest high.

Exchange balances drop to six-year low

On Saturday, the total Bitcoin balance in centralized exchanges dropped to its lowest level of six years at 2.83 Million BTC. according Glassnode

In early June of 2019, the coin was valued at $8,000 and was the height of the bear market.

CryptoQuant’s blockchain analysis platform has slightly less total reserve figure This is the lowest it has been in 7 years.

The BTC balance on both platforms has fallen dramatically in the last two weeks. Glassnode says that more than 114,000 BTC valued at over $14 billion have been removed from exchanges during the past two weeks.

Bitcoin is moved from centralized exchanges to self-custody or institutional funds. digital asset treasuriesThis indicates that the holders intend to keep their bitcoins for long term and not sell them. Bitcoins that are parked on exchanges can be considered. “available supply” The market could liquidate and sell the product at any minute.

Exchanges running dry

“Hearing exchanges are out of Bitcoin,” said Matthew Sigel was the VanEck head of research for digital assets on Saturday.

“Monday 9:30 am might be the first official shortage,” He said, before adding: “Not financial advice… just: it might make sense to get some.”

Mike Alfred, investor and trader said On Sunday morning “I just got off a 20-minute call with THE guy who runs the most important OTC desk.”

“He says at the current pace, they will be completely out of Bitcoin to sell within two hours of futures opening tomorrow, unless the price goes to $126,000 to $129,000. Things getting wild.”

Magazine: Bitcoin may move ‘very quick’ to $150K, altseason doubts: Hodler’s Digest

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com