Important points

-

Bitcoin is disappointed by the volatility surrounding US job data. The result was a drop below $111,000

-

BTC’s price drops all of its gains, while gold continues to reach new highs.

-

Investors continue to anticipate a $100,000 retest of the support.

BitcoinBTCThe Wall Street opening was volatile as US employment data came in far below expectations.

Gold surpasses US employment records “rapidly deteriorating”

The following data is from Cointelegraph Markets Pro The following are some examples of how to get started: TradingView The BTC/USD pair reached new highs in September of $113.400, before falling by almost $3,000 within an hour.

The August print of US nonfarm payrolls (NFP) confirmed that the economy added 22,000 jobs — far fewer than the anticipated 75,000.

In response, the US Dollar’s value plummeted while Gold reached all-time records.

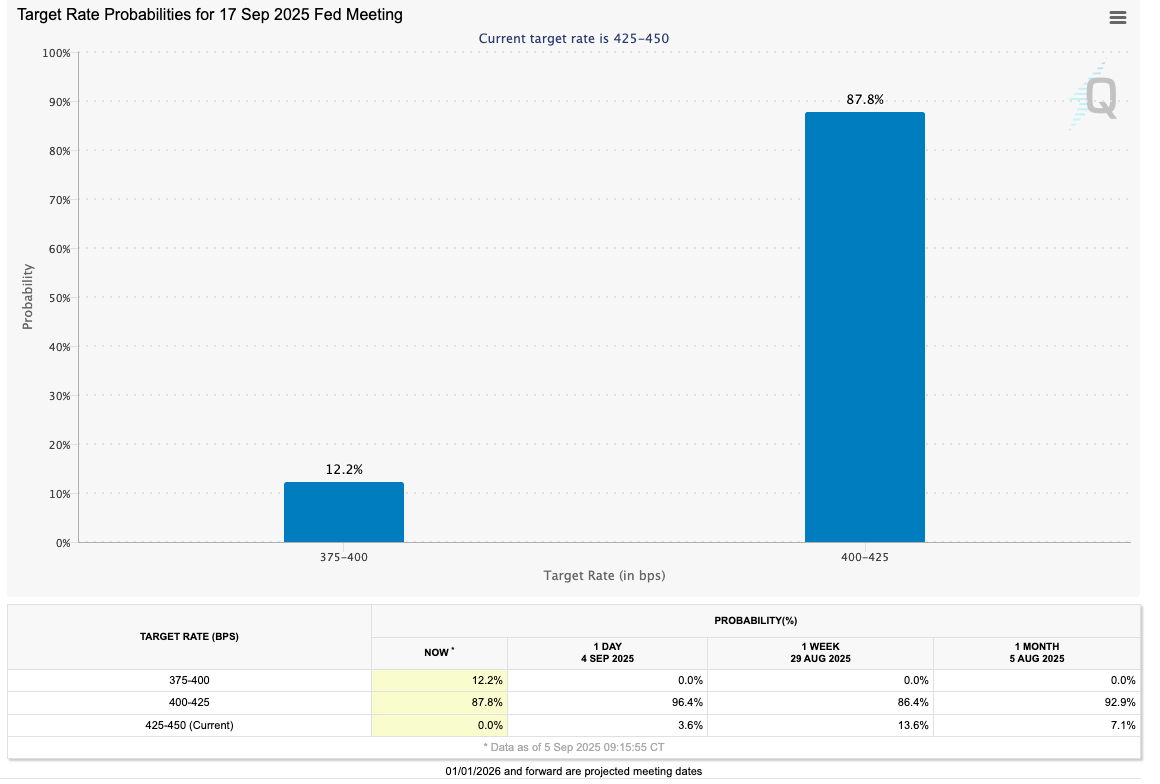

Participants in the market agreed, as they reacted to the news, that the Federal Reserve was likely going to be a significant risk asset tailwind. cutting interest rates At its meeting on September 17,

CME Group data FedWatch Tool The likelihood of this outcome was highlighted.

“This marks the 2nd lowest jobs report number since July 2021,” The Kobeissi Letter, written as part of an article on trading resources thread on X.

“The labor market is rapidly deteriorating.”

Kobeissi pointed out that job numbers from previous months have also been revised downward.

“The labor market is far worse than you think: Not only was June’s jobs number negative, but the US economy lost -357,000 full time jobs in August,” founder Adam Kobeissi added.

Bitcoin Price Targets Double Down on $100,000 Drop

The BTC market showed a lackluster response despite the NFP’s positive impact on Bitcoin.

Related: Bitcoin sets 2024-style bear trap ahead of ‘major short squeeze’: Trader

WhalePanda, a popular market commentator and participant in the discussion, was among those who took note.

Who is blocking Bitcoin? pic.twitter.com/iOKhtC7Z3O

— WhalePanda (@WhalePanda) September 5, 2025

The traders instead focused on key resistance levels that still need to be turned back into support. Daan Crypto Trades, a popular trader, highlighted the moving averages of 200 periods for both simple (SMA), and exponential (EMA), on four-hour frames.

“The 4H 200MA & EMA are generally seen as a good momentum indicator for the short to mid timeframe trend. These have both acted as resistance for the past few weeks and are now being tested again,” Part of a X Post explained

“This is a very crucial level to reclaim for more upside,” ZYN is a fellow trader agreed Additions to the price range before NFP “bulls will be fully back” Return of $113,000 in support.

Ted Pillows reiterated that he expected a decline to $100,000.

“Also, if this level doesn’t hold, BTC could go around $92K-$94K CME gap level,” He warned On the Day

This article contains no investment recommendations or advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making a final decision.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com