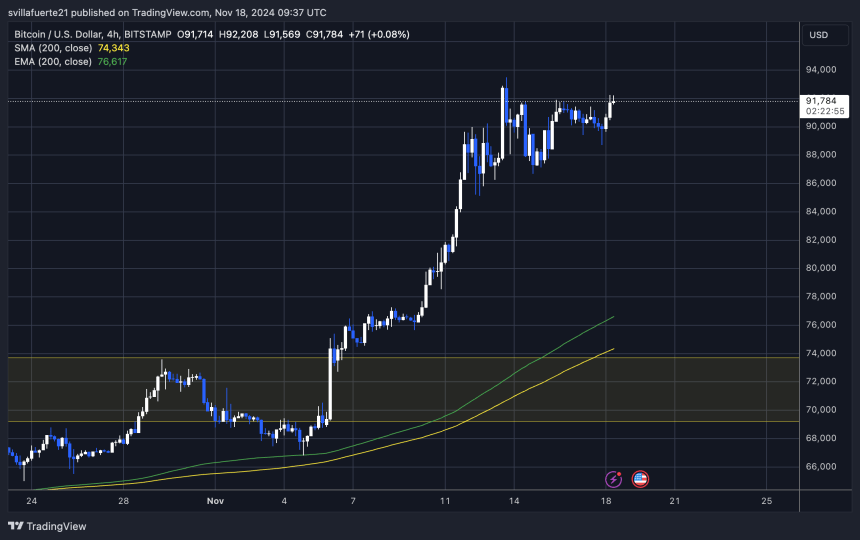

Bitcoin’s price movement was robust over the past weekend as it traded in a small range from $91,700 up to $88,700. Bitcoin is still strong and the market has confidence despite its lack of price movements.

CryptoQuant’s key data reveals a significant reduction in the selling pressure, adding to optimism. These data show fewer buyers in the market which is consistent with the recent bullish sentiment fueling Bitcoin. Demand could drive BTC up, bolstering the price movement seen last weekend.

Read Related Articles

Bitcoin’s ability to take advantage of favorable market conditions has led many analysts to predict a significant surge over the next few months. Analysts believe that, as long as the demand continues to increase and selling pressure is limited, Bitcoin will be ready for its second significant breakthrough.

Investors closely monitor this trend to determine if it will result in a potential new upward phase. pushing BTC into uncharted territory as the market anticipates the next major move This bullish cycle is a good example.

Bitcoins Flow to Exchanges Supports Bulls

Bitcoin’s recent surge of 39% over just nine days is one of the most explosive upward movements this cycle. Analysts and investors are both cautious and excited by the recent rally as Bitcoin shows resilience over key levels. Many expect BTC’s upward trajectory to continue. However, buying BTC at lower price points is becoming more difficult.

Data from CryptoQuant analyst Axel Adler This provides valuable insights into current market dynamics. Adler points out that Bitcoin flows to exchanges in the last 30 days have not exceeded the volume of the previous 365 days.

It is clear that there has been little selling pressure. This suggests current Bitcoin holders would rather keep their Bitcoins than to sell them into the upswing. Bitcoin can rise in value as there are fewer buyers on the market.

Read Related Articles

Analysts agree, however, that consolidating around the current range of prices would be an excellent step to take before the next upswing. Consolidation may allow the market stabilize itself, bring in new demand, and create a stronger base for growth.

BTC is less than 2% away from ATH

Bitcoin currently trades at $91,700. This is just a little under 2% off its previous all-time (ATH) high of $93,483. Investors are encouraged by the fact that the Bitcoin price is so close to the record high. It appears to be poised to surpass the ATH this week. Bitcoin’s price is still strong due to the increasing market demand.

BTC’s ability to hold key levels in periods of consolidation has been credited with its sustained strength. The fact that buyers are still in control indicates a continued dominance, which could lead to another break above $93,483. The analysts expect that breaching the $93,483 mark would spark a new wave of aggressive purchasing, possibly driving Bitcoin even further out into unknown territory.

Read Related Articles

The caution still remains. Bitcoin would retrace if it fell below $87,000. This could trigger a small correction over the next couple of days. A move like this could help lay a better foundation for BTC’s growth in the future, as it would allow BTC to consolidate itself and draw new demand.

Featured Image from Dall E, Charts from TradingView

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com