The following are key points.

-

Bitcoin’s surge through the $112,000 barrier brings weekly volatility to a close.

-

The BTC price is continuing to recover, and traders expect new local highs.

-

Next week, the US Federal Reserve will likely cut rates once more.

BitcoinBTCThe local market closed at $112,000 on Sunday, as investors hoped to reach new highs.

Bitcoin eyes traders’ targets in fresh volatility

The Data of Cointelegraph Markets Pro The following are some examples of how to get started: TradingView According to the data, a BTC-price range was evident over the weekend.

Bulls moved to higher levels in the weekly range after a Friday late recovery. pleasing US inflation data.

The weekly closing is usually more volatile, and market participants are now looking for new highs.

Long over $108,200. Next, I’m aiming for $113,000 as my target. pic.twitter.com/aXZtvseqtO

— Crypto Tony (@CryptoTony__) October 26, 2025

Crypto Caesar, a trader from the Crypto Group observed that the resistance level of $112,000 was being tested on this day.

“A CLEAN break and close above it could confirm a bullish continuation toward $123K,” He wrote In a comment on X.

Ted Pillows is a cryptocurrency investor and entrepreneur who had similar thoughts.

“$BTC seems to be in a short-term uptrend. 4 consecutive green daily candles, which means someone is consistently TWAPing Bitcoin here,” He told X Followers on the Day

“I’m still eyeing a $112,000-$114,000 zone, as a reclaim could push BTC above $118,000 really soon.”

The X analytics account was named in honor of the economist Frank Fetter “watching” Break of $113,000.

Watching $BTC. pic.twitter.com/8FOK6ntCxo

— Frank (@FrankAFetter) October 25, 2025

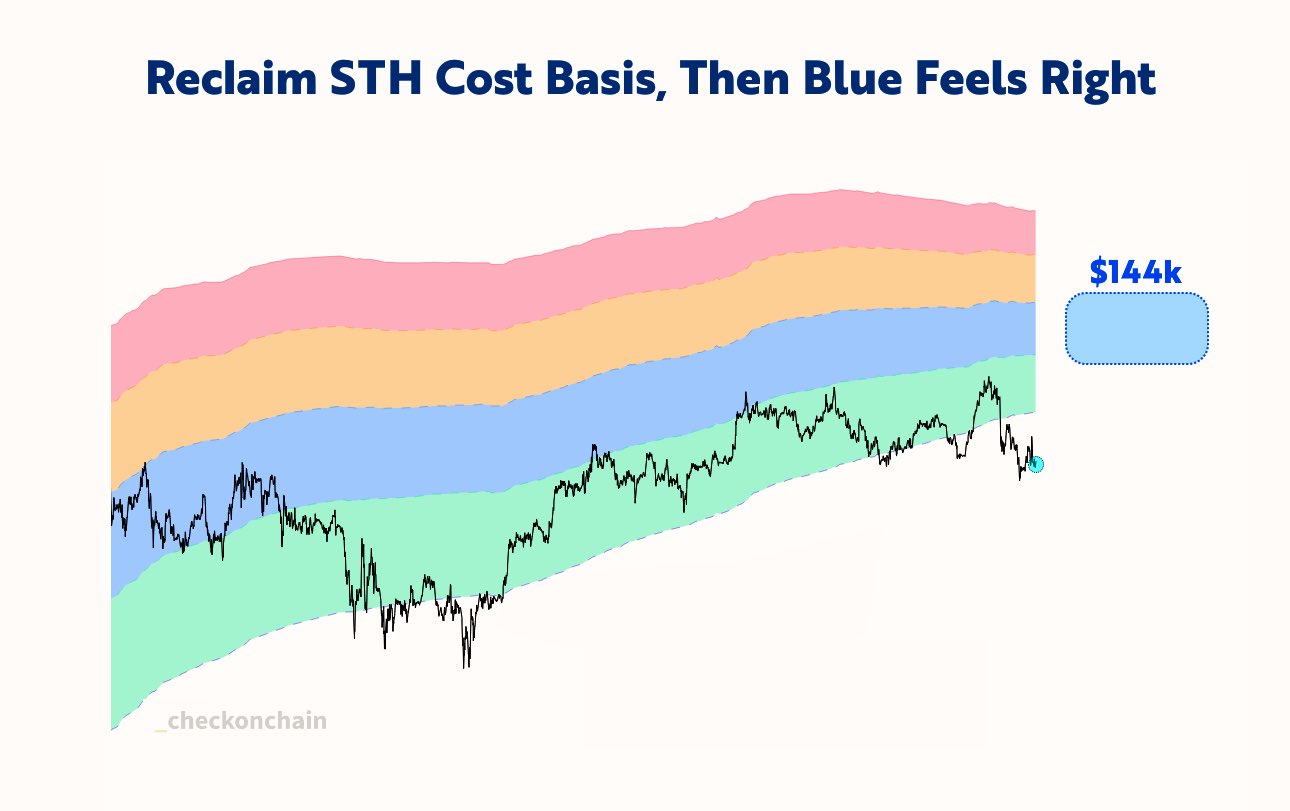

Then, you can say that. added last week, represented the current aggregate cost basis for Bitcoin’s short-term holders — entities hodling for up to six months.

“If BTC can reclaim the short-term holder cost basis at $113k, a move into the blue band of $130k – $144k feels right,” I said.

Fed rate-cut odds boost risk-asset play

Another important event is coming up for investors in cryptoassets.

Related: Worst Uptober ever? Bitcoin price risks first ‘red’ October in years

Fresh from lower-than-expected numbers for inflation, the US Federal Reserve was expected to reduce interest rates at its meeting on October 29 by 0.25%.

CME Group Data FedWatch Tool At the time this article was written, the probability of such an outcome exceeded 98%.

Trading resource, The Kobeissi Letter puts the Fed’s rate cuts into context in a global rates environment “pivot” By central banks

“So far, 82% of world central banks have cut rates over the last 6 months, the highest share since 2020. This century, central banks have slashed rates at a pace only seen during recessions,” It is a good idea to get a hold of someone else. wrote on X.

“Global monetary easing is in full swing.”

The article is not intended to provide investment advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making a final decision.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com