The following are key points.

-

Bitcoin’s surge through the $112,000 barrier brings weekly volatility to a close.

-

The BTC price is continuing to recover, and traders expect new local highs.

-

Next week, the US Federal Reserve will likely cut rates once more.

BitcoinBTCAs traders looked for local highs, ), challenged $112,000 at Sunday’s close.

Bitcoin eyes traders’ targets in fresh volatility

The Data of Cointelegraph Markets Pro The following are some examples of how to get started: TradingView The weekend was characterized by a BTC range bound price movement.

Bulls moved to higher levels in the weekly range after a Friday late recovery. pleasing US inflation data.

The weekly closing is usually more volatile, and market participants are now looking for new highs.

I am holding my long above $108,200. The next target is $113,000. pic.twitter.com/aXZtvseqtO

— Crypto Tony (@CryptoTony__) October 26, 2025

The $112,000 level of resistance was retested by Trader Crypto Cesar on that day.

“A CLEAN break and close above it could confirm a bullish continuation toward $123K,” He wrote In a comment on X.

Ted Pillows, a crypto investor and entrepreneur, had the same ideas.

“$BTC seems to be in a short-term uptrend. 4 consecutive green daily candles, which means someone is consistently TWAPing Bitcoin here,” He told X Followers on the Day

“I’m still eyeing a $112,000-$114,000 zone, as a reclaim could push BTC above $118,000 really soon.”

The X analytics account was named in honor of the economist Frank Fetter “watching” For a break in the amount of $113,000.

Watching $BTC. pic.twitter.com/8FOK6ntCxo

— Frank (@FrankAFetter) October 25, 2025

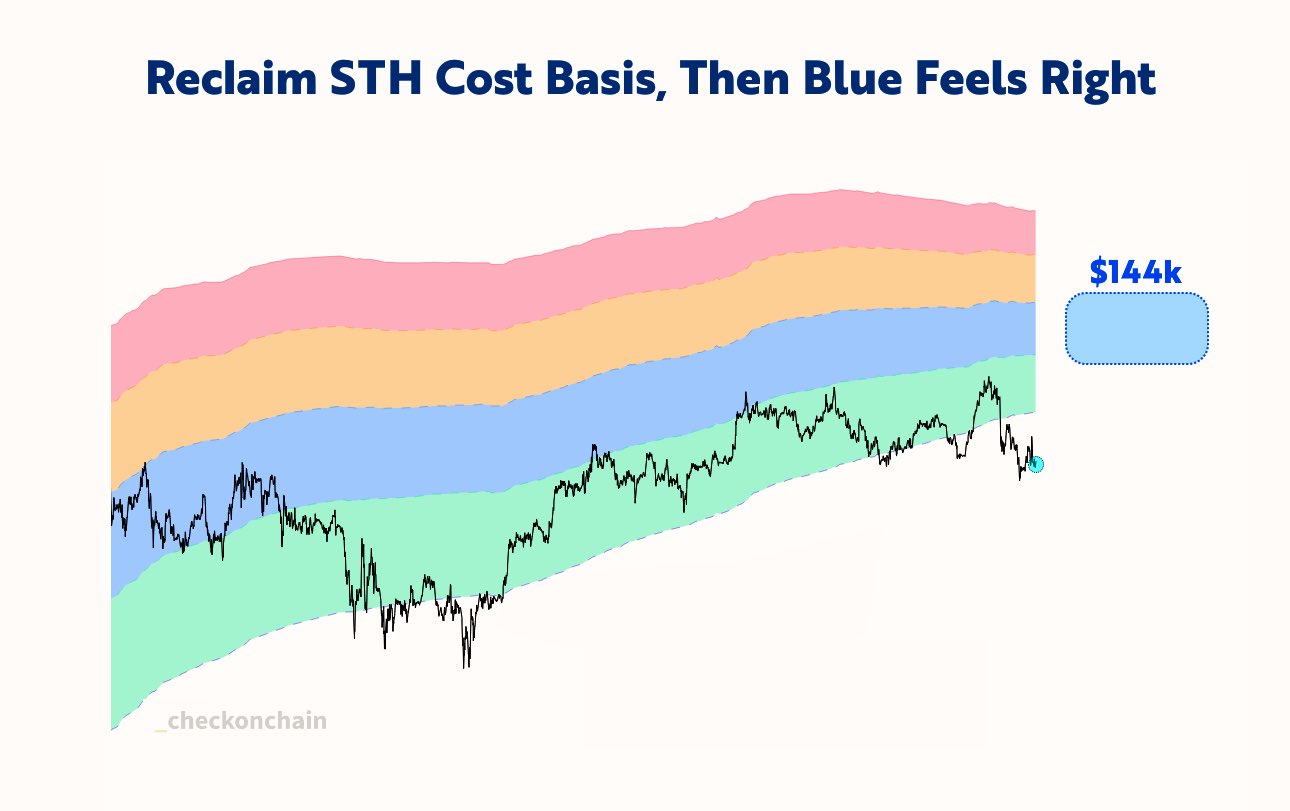

Then, you can say that. added last week, represented the current aggregate cost basis for Bitcoin’s short-term holders — entities hodling for up to six months.

“If BTC can reclaim the short-term holder cost basis at $113k, a move into the blue band of $130k – $144k feels right,” It was said.

Fed rate-cut odds boost risk-asset play

Another important event is coming up for investors in cryptoassets.

Related: Worst Uptober ever? Bitcoin price risks first ‘red’ October in years

After announcing lower than expected inflation figures, it was anticipated that the US Federal Reserve would cut rates by 0.25 percent at its October 29th meeting.

CME Group Data FedWatch Tool As of the date of this writing, odds on that result were more than 98 %.

Comments on the trading resource Kobeissi Letter placed Fed cuts within a global rate environment. “pivot” Central banks are responsible for regulating the financial system.

“So far, 82% of world central banks have cut rates over the last 6 months, the highest share since 2020. This century, central banks have slashed rates at a pace only seen during recessions,” It is a good idea to get a hold of someone else. wrote on X.

“Global monetary easing is in full swing.”

The article is not intended to provide investment advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making any kind of decisions.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com