Binance’s key trading volume metric, which is the most important metric for the crypto-exchange, indicates that the buying power of the platform has increased.

The Binance Taker buy sell ratio, which is a calculation of the ratio between buyers and sellers of Bitcoin.BTCBinance is a cryptocurrency exchange. “has returned to neutral territory,” CryptoQuant contributor DarkFost said Note dated 15 April

The bullish Bitcoin momentum has been gaining strength. “picking up again”

The current ratio is 1.008. When the ratio is higher than 1, buyers — usually a bullish sentiment indicator — dominate volumes, conversely, a ratio below 1 indicates that sellers, or bearish sentiment, are dominating.

Bitcoin’s price at time of publication was $83,810. Source: CoinMarketCap

Bitcoin has fallen 1.47% since the previous seven days to $83,810. according CoinMarketCap Data

“Over the past few days, the ratio has been mostly positive, suggesting that bullish sentiment is picking up again on Binance’s derivatives market,” Darkfost explained. The ratio exceeded 1.1 on April 14 when Bitcoin surpassed $86,000.

CoinGlass data shows As a result, if Bitcoin returns to $85,000 in value, there is a risk that almost $637,000,000 of short positions could be liquidated. A number of key indicators indicate that investors are still favoring Bitcoins over other altcoins.

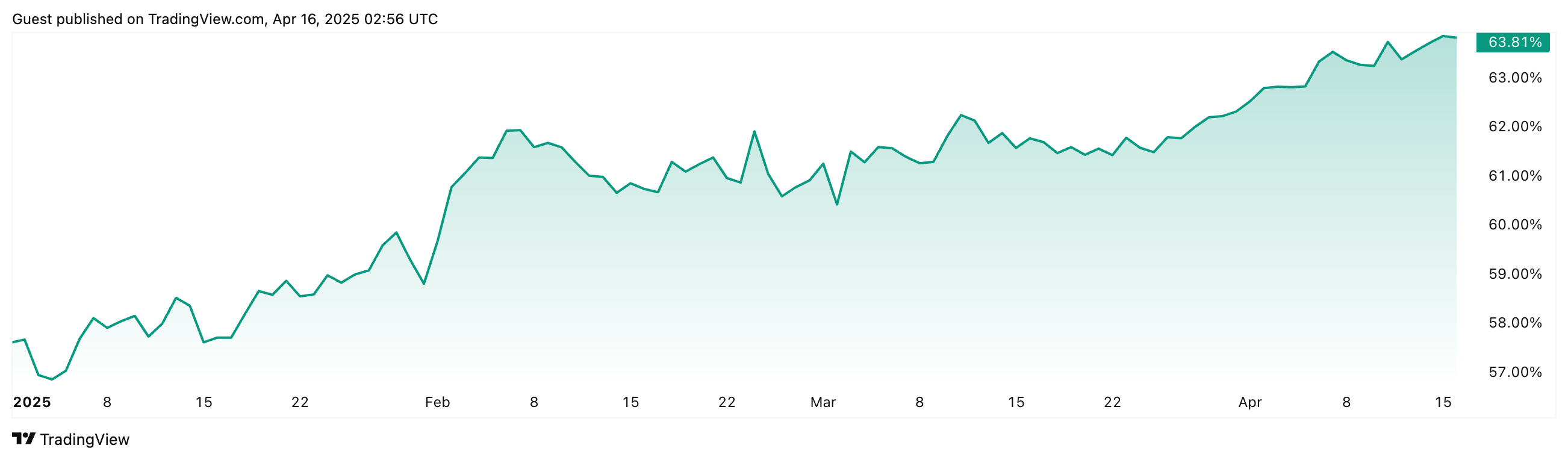

CoinMarketCap Altcoin Season Index Currently, the index is at 15, indicating that there is still a lot to do “Bitcoin Season.” TradingView Bitcoin Dominance Chart The asset’s share of the market is 63.81% and has increased by 9.82% this year.

Source: Bitcoin Dominance has increased by 9.88% from the start of 2025. Source: TradingView

The crypto market is still hampered by a general feeling of hesitancy. The Crypto Fear & Greed Index shows The overall sentiment of the market on April 16, 2019 is positive. “Fear” Score 29.

DeFiDaniel is one of many analysts who have a strong opinion about the future. commented Bitcoins price movement is a recent phenomenon. “so boring.”

Cointelegraph reported earlier that Bitcoin’s apparent demand was on a path of recovery. but it is not net positive yet. Histoically, the 30-day apparent price can remain sideways after Bitcoin has reached a bottom.

Related: Bitcoin price recovery could be capped at $90K — Here’s why

Bitcoin analysts have different opinions about where it will go next.

Real Vision Chief crypto analyst Jamie Coutts told Cointelegraph Late March is a good time to buy. “the market may be underestimating how quickly Bitcoin could surge — potentially hitting new all-time highs before Q2 is out.”

AnchorWatch Chief Executive Rob Hamilton said Bitcoin was reported to be at a record high in a post on April 15, 2015 by X. “is flat for the day because we are in an epic tug of war between people who are selling Bitcoin to pay their taxes and people using their refunds to buy Bitcoin.” Tax deadlines in the US were April 15th.

Magazine: Is Cambria S2 the riskiest, most ‘addictive’ crypto game of 2025? Web3 Gamer

This article contains no investment recommendations or advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making any kind of investment.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com