Takeaways from the conference:

-

Bitcoin researcher Sminston With believes BTC can gain between 100% and 200% with a peak cycle of $220,000-$330,000.

-

Bitcoin’s price fluctuations continue to be volatile, contrary to the popular belief that they are easing over time.

-

Holders of BTC for a long time have sold over $4 billion worth, signaling a correction in price.

Bitcoin Analysis (BTC) Sminston With said that BTC prices are still between 100 and 200% off their current levels. In a recent X post, With shared a Bitcoin price chart using a 365-day simple moving average (SMA) aligned with a power law model (R²=0.96).

Models of exponential growth are often used to predict the price of stocks or equities.

In each cycle, the 365-day SMA of Bitcoin peaks at a distance 2 to 3x higher than power law’s trendline. Model predicts that Bitcoin will reach a cycle high between $220,000-$330,000. The forecast is in line with past patterns where Bitcoin consistently exceeded this trendline when it was bullish, giving investors an optimistic outlook.

Another graph shows Bitcoin’s deviance from the power law, with cyclical price volatility that is not exponentially decayed.

It is a challenge to the popular belief that Bitcoin price cycles have become less extreme with time. This shows that Bitcoin volatility will remain a hallmark of the currency, leading to potentially significant price swings in the next few weeks.

The Q3 of 2024 will be marked by the following: accurately predicted Bitcoin was predicted to reach six figures by 2025 when BTC traded at around $60.000. Analysis of each peak was done by measuring BTC at its cycle highs.

The decaying phase of an investment cycle is when the returns on a particular strategy declines as it becomes more widely accepted. It culminates in a high where the asset value plummets, resulting in mass profits-taking.

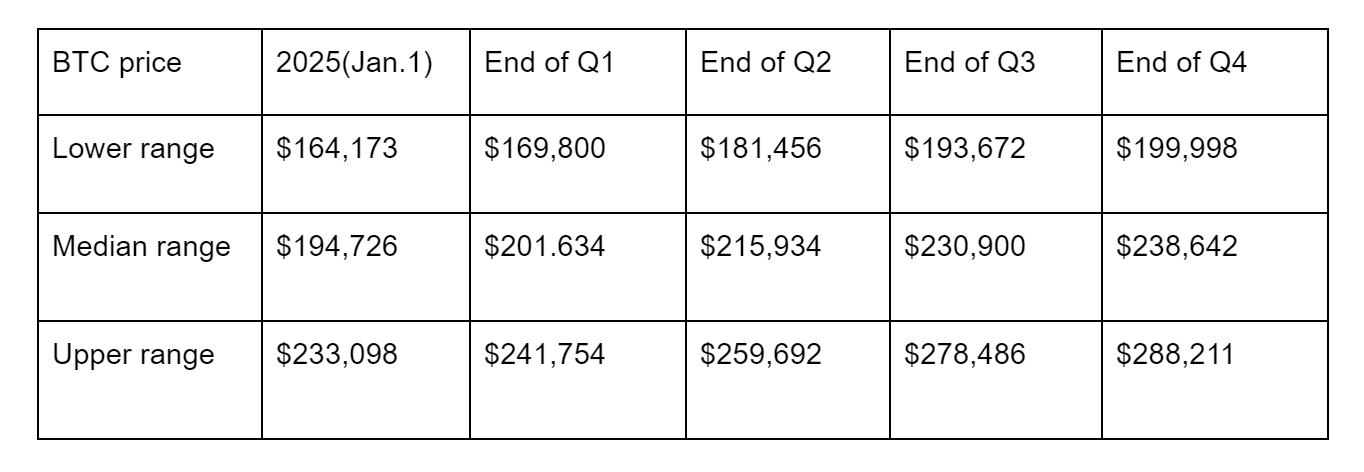

Below are the price targets that With has set for each quarter of 2025. These prices were outlined by this report.

Researchers cautioned that their study was based only on four cycles of the market and it should be viewed with a high degree of skepticism.

Related: Bitcoin price will reach $130K or even $1.5M, top bulls say

Bitcoin dips below $108K as old coiners move $4.2 billion in BTC

Bitcoin LTHs have spent $4.02 Billion in BTC. This is the highest spending by the cohorts of 1 to 5 years since February 2025. according to Glassnode. The 3-to-5 year cohort (2,16 billion) is the driving force behind this surge. It ranks as the fifth largest in this cycle. Previous spending peaks, such as $9.25 in October 2024, were also a part of it.

In terms of total spending, the cohorts between 2-to-3 years old and 1-to-2 years contributed respectively $1.41 and $450,000,000.

BTC struggles to hold its current position over $110,000. This is illustrated by the graph. LTH spend often corresponds to price peaks.

However, if the price movement is accompanied by an increase in BTC reserves then sharp movements may follow. BTC reserves are currently totaling around 50,000. held on exchanges continues to decline.

Since its bottom price of $74,500 in 2014, Bitcoin prices have been rising. After each new high BTC forms a sideways channel before it breaks out again.

In the ongoing correction, recent lows in local currency at $107 300, which were local highs just 10 days ago, are a reflection of this pattern. Bitcoin could face a more severe correction.

TXMC anonymous crypto trader noted, based on historical data that Bitcoin may be approaching the end of its green-weekly streak. The analyst stated,

“BTC Seven to eight consecutive green weeks are the longest streaks Bitcoin has managed since 2013, before it has pulled back or consolidated. Last week was #7.”

Related: Bitcoin sags below $108K as rate-cut bets evaporate before Fed minutes

This article contains no investment recommendations or advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making a final decision.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com