The Attorney General’s office of Washington, DC, filed a lawsuit against crypto ATM operator Athena Bitcoin, alleging that the company charged undeclared fees on deposit it knew was tied to scams, and did not put in sufficient fraud protections.

DC Attorney-General Brian Schwalb alleged The 93% deposit rate on Athena for the first five months was announced on Monday. “direct result of scams” And criticized firm’s “no-refund” policy. According to him, this prevents the victims from recovering unreported fees and losses due to scams.

“Athena knows that its machines are being used primarily by scammers yet chooses to look the other way so that it can continue to pocket sizable hidden transaction fees.”

The FBI reported that nearly 11,000 complaints of fraud Over $246 million was lost by 2024. To reduce the impact, at least 13 states have implemented limits on transactions, such as Arizona, Colorado, and Michigan. crypto ATM fraud.

Athena failed to respond immediately when asked for a comment.

Athena is alleged to have made six figures in fees.

Schwalb’s Office filed a court document alleged Athena charges up to 26% in fees per transaction. “clearly disclosing them at any point in the process.”

Athena, the office claimed, misled its users when it referred to an “Transaction Service Margin” Its Terms of Service also includes a list of prohibited activities. “fee” It was never said.

Athena is accused of engaging in unfair, deceptive trade practices and violating the laws meant to protect vulnerable adults. elderly from abuseNeglect, financial exploitation and neglect.

Athena, according to the Attorney General’s Office, allegedly abused children. “pocketed hundreds of thousands of dollars in undisclosed fees” In the first five months that DC operates between May 2024 and September 2024, it will receive complaints from victims of scams, including many elderly or vulnerable people.

According to the complaint, the average age of the victims was 71 and the median amount lost per transaction was $8,000. The filing also claimed that a DC resident had lost $98,000 in a scam perpetrated at an Athena kiosk.

Schwalb’s Office claimed Athena had “ineffective oversight,” What it says creates an “unchecked pipeline for illicit international fraud transactions.”

“Athena has permitted and profited from transactions in which victims are coerced, misled, and manipulated into depositing their life savings into Athena’s machines under fraudulent pretenses.”

Avoid being scammed by crypto ATMs

Schwalb described this as “predatory conduct,” Crypto ATM users shouldn’t send funds Someone they have never met. Especially if they are contacted randomly.

Related: Tasmanian police find top 15 crypto ATM users are scam victims

Scammers often pose as crypto-tech support specialists, saying that the victims’ funds are at risk. Or, they may pretend to be a trader, promising to make huge profits with little or no risk.

If you receive random requests, do not respond to them. Instead, contact the person or institution they represent via official channels.

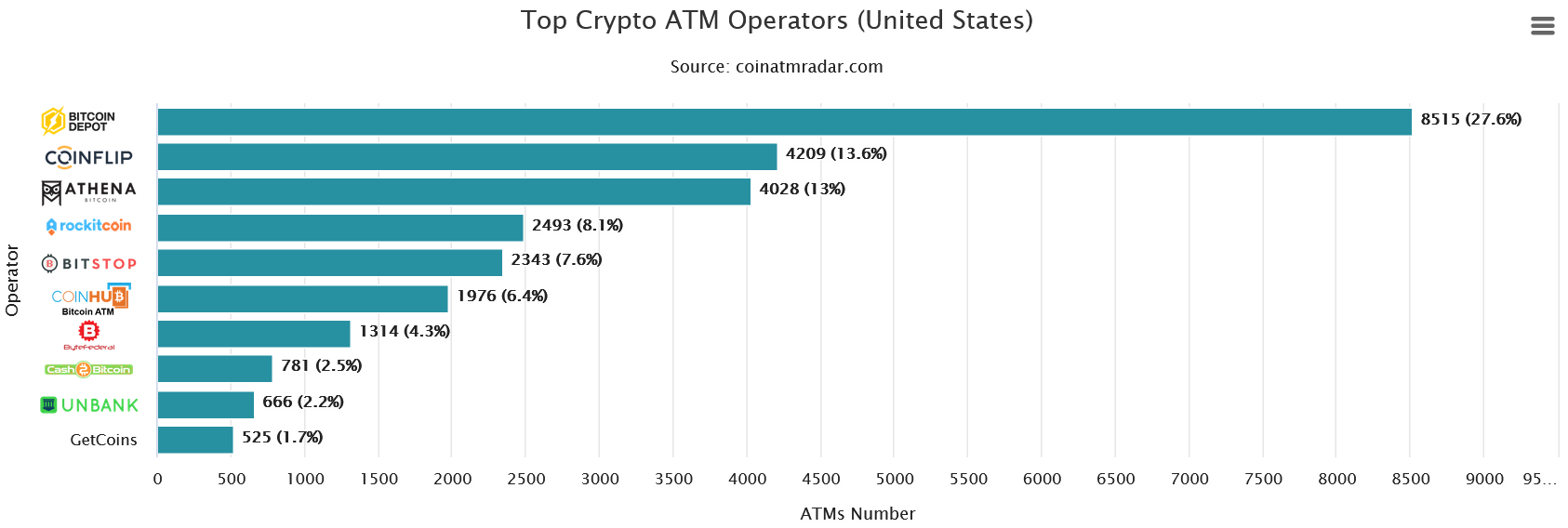

There are currently 26,850 crypto ATMs The US according CoinATMRadar is a great resource. Bitcoin Depot is the owner of 27.6% machines followed by CoinFlip at 13,6% and Athena with 13%.

Unreported fee scandals in the banking sector

The DC Attorney General claims that it has been illegal to not disclose the fees. prolific issue The banking sector is a growing industry.

Federal Deposit Insurance Corporation (FDIC) ordered Discover Bank in April to refund around $1.2 Billion in fees that it had overcharged customers. Wells Fargo, on the other hand, was fined $3.7 Billion in December 2022 after being found to have illegally charged mortgage fees and interest.

Bank of America also had to pay out over $250 Million for charging “junk fees” By 2023.

Magazine: 3 people who unexpectedly became crypto millionaires… and one who didn’t

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com