Why trust?

A strict editorial policy focusing on accuracy, relevancy, and impartiality

Created and reviewed by professionals in the field

Reporting and Publishing at the highest level

Editorial policy that is strict and focuses on accuracy. Relevance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s latest market movement shows a continued upward trajectory, even if short-term fluctuation suggests some cooling. BTC is currently trading at $103,485, a drop of 0.6% in the last day and nearly 10% over the previous week.

The asset is still just over 5% off its January high, which was $109,000. It continues to be near records. The pattern indicates that Bitcoin is entering a phase of consolidation, underpinned by fundamentals which are bullish over the long term.

While this performance is being observed, the renewed interest amongst long-term investors about the durability of the price range and its future has been generating. potential for future volatility.

Read Related Articles

The Bitcoin binary CDD Signals Market Rotation

CryptoQuant Analyst Avocado Onchain was recently interviewed highlighted Binary Coin Days destroyed (CDD) is a crucial indicator that helps to assess long-dormant bitcoin’s behavior. When older coins move after long periods of inactivity it is a sign that holders are reentering or about to sell.

In the past, Binary CDD spikes have been associated with tops of markets or phases when distribution to early holders from newer holders has increased. market participants increases. Avocado claims that applying a moving average of 30 days to Binary CDD will smooth the data, and provide a better view of macrotrends.

Binary CDD surpassed the 0.8 level during past Bitcoin rallies. The Binary CDD has traditionally been a good indicator of long-term holdings, as it often correlated with increased selling pressure Profit-taking is a form of behavior.

As Bitcoin attempts to test its highest levels, the indicator has been trending up. Binary CDD may indicate another distribution wave if it crosses the 0.8 threshold again.

Monitoring Profit Realization Behavior

Binary CDD’s ability to accurately reflect changes in market structure is what makes it useful. If long-term BTC investors start to move large amounts, this can be a signal of profit taking, particularly if it is accompanied by high prices and strong market sentiment.

To interpret the indicator fully, it is important to consider other factors, including exchange flows and trading data.

The current increase in Binary CDD could indicate that Bitcoin is entering a new phase. It may not be the end of an ascending trend but rather a transitional stage. notable investors Are gradually rotating their capital or reacting to price movements in anticipation of short-term change?

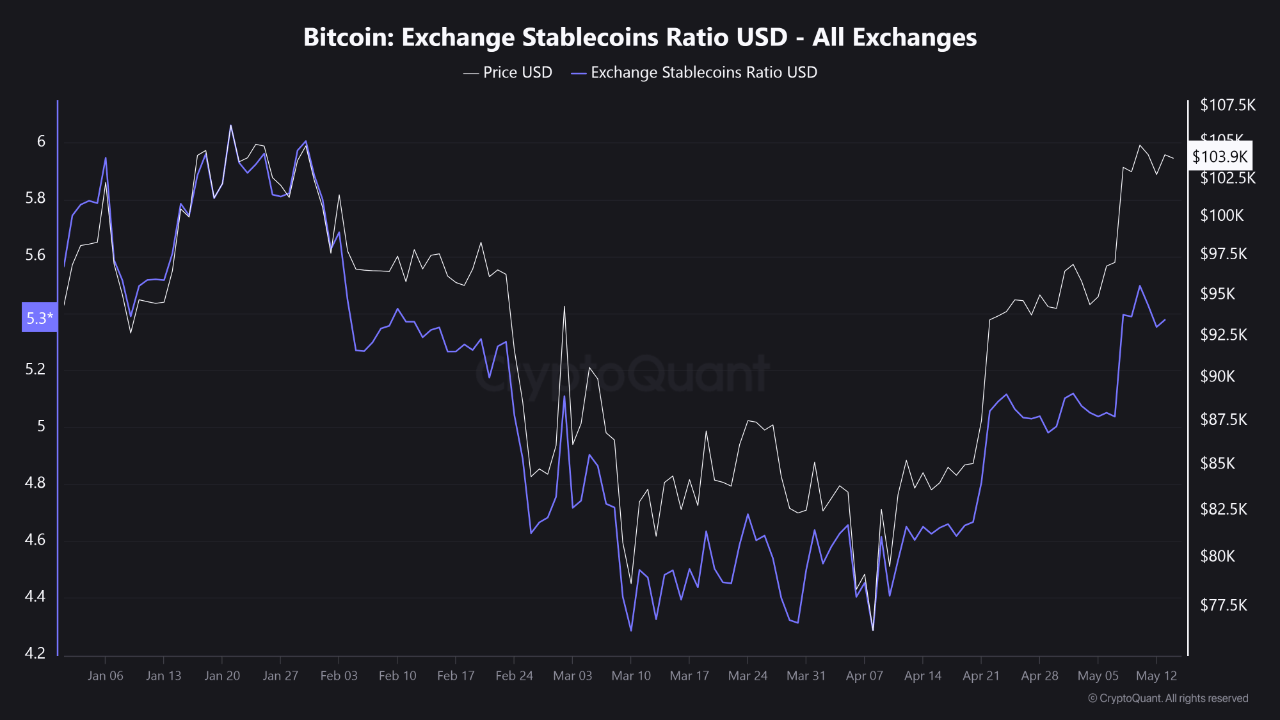

EgyHash is another CryptoQuant market analyst who has issued a different signal. highlighted Exchange Stablecoins ratio (USD) is one metric used to compare Bitcoin reserves with stablecoins that are held by exchanges. Source: CryptoQuant

EgyHash says that the ratio of this market has increased to a level around 5.3. It is higher than the threshold value of 5.0.

This reading may indicate that more traders are planning to sell BTC, or to convert their BTC to stablecoins, fiat, or equivalent currencies.

Charts from TradingView and DALLE were used to create the featured image.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: www.newsbtc.com