Three vital market indicators suggest that ETH may be able to extend its lead in the coming weeks.

EthereumETH) Bitcoin (BTCETH and BTC have historically been closely correlated. However, in 2024 ETH appears to have the upper hand. Expert analysis and a deep dive into on-chain trends provide key insights on which asset will be the winner as the year unfolds.

Ethereum – Is it better than Bitcoin by 2024?

In 2024, Ethereum, Bitcoin and other crypto assets have seen capital inflows in the billions. BTC’s price is currently trading at $71,200, a historic high. ETH, on the other hand, is trying to maintain a stable support above $4,000 in March 2024.

A closer look at price charts reveals that ETH has currently surpassed BTC in terms of performance year-to date by 7%.

The chart shows that ETH has risen 79% in price between January 1 and March 11, 2024. That is a much higher price increase than Bitcoin (72%).

While ETH has the advantage at present, it’s important to consider the market factors that will drive the asset in 2024.

It is important to first note that in 2024, both assets will be driven by different narratives and market drivers.

Ethereum’s ongoing ETH ETF filings include the Eigen-layer restaking, derivatives of liquidity staking, and Dencun. upgrade In Q1 2024, there are several major themes that have emerged. Bitcoin’s dominant themes are the rapid growth of demand and the rapidly increasing price. 10 newly-approved BTC ETFs This upcoming event will be held on April 19th, 2024.

These key events triggered diverse changes to on-chain transaction patterns and investment habits across both ecosystems. As a result, Ethereum is now outpacing Bitcoin in price.

Ethereum Price Could Outperform Bitcoin by 2024

- Institutional investors dominate BTC markets, but retail investors rally behind ETH

The US Securities and Exchange Commission has approved 10 new Bitcoin Exchange Traded Funds (ETFs) on January 11, 2024. This is a major milestone for the cryptocurrency industry. Within 2 months of launch, ETFs had acquired around 800,000 BTC. This is about 4.2% the total supply.

In 2024, corporate institutional investors made record-breaking investments in Bitcoin. This has clearly benefited the price of Bitcoin. Interesting, ETF dominance among BTC retail investors has led to a cautious reaction, despite the apparent progress of the Ethereum eco-system growth.

Santiment’s total holders metric calculates the number of wallet addresses active or funded that exist currently on a Blockchain network. It can be used as a proxy to measure the level of adoption in the retail and mass markets.

In the past 50 days, starting on Jan. 21st, the Ethereum network attracted 3,59 million new address holders. Meanwhile 200,000 BTC address holders emptied their BTC wallets and left the network.

This on-chain rare trend indicates that Bitcoin is overwhelmingly supported by the mass retail markets. Bitcoin’s concentration in the hands of corporate entities and whale investors puts BTC at risk from market manipulation.

The increase in the number of new Ethereum addresses compared to BTC addresses that empty their wallets indicates a divergence between retail investor sentiment for the two cryptocurrencies.

This trend shows that investors prefer Ethereum to Bitcoin. This could be due to Ethereum’s promise of passive income and profit optimization from its low-risk staking yields to its retinue decentralized finance applications.

Moreover, the increasing dominance of corporate entities and institutional investors in the Bitcoin markets introduces another layer of risk and uncertainty. Institutional adoption is a major driver behind the recent Bitcoin price rally. It also makes it more vulnerable to large-scale selling or coordinated trading by these influential players.

In the event that a downturn in the tradfi markets or macroeconomic policies change, the concentration of Bitcoins in the hands highly-sensitive Wall Street investors could worsen BTC price drops and increase market volatility.

- Bitcoin Miners Trade Bearish While Ethereum Node Validators Remain Bullish

A divergence of trading preferences between Bitcoin miners, and Ethereum node validaters could be another important market catalyst driving ETH’s price ahead of BTC. The Bitcoin network relies on miners to validate transactions, secure the network and reward them with BTC blocks. Ethereum’s Proof of Stake (PoS) has shifted to relying on its node validaters for this crucial function.

Bitcoin’s next The halving event scheduled for April 19 will see the miners’ reward slashed to 3,13 BTC from 6,25 BTC. Bitcoin miners, who have less than 40 days until the event, are selling in an attempt to get a profit before the halving.

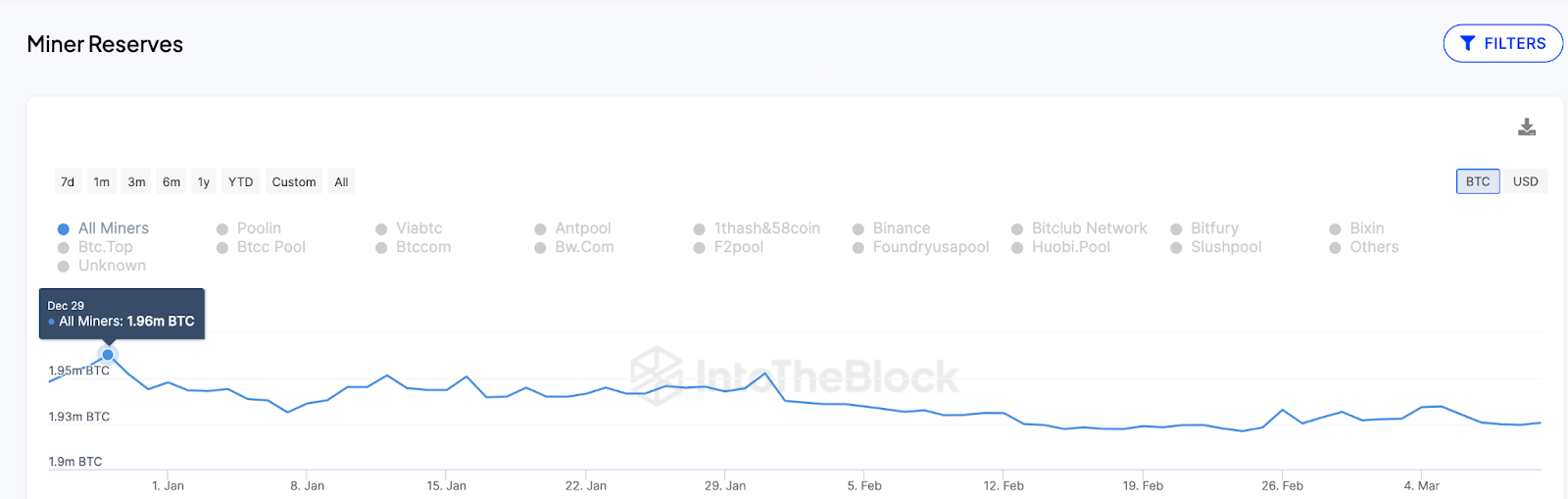

Bitcoin miners had 1,96 million BTC as of December 29th 2023. As the date for halving drew nearer, miners quickly sold 300,000 BTC. Their balances were now just 1,93 million BTC as of March 11, 2024.

Miners have sold BTC valued at $71,200 in Q1 2024 before the halving.

If Bitcoin’s mining trend continues to sell, this could cause the BTC rally to slow down, particularly in comparison with Ethereum whose validators of nodes have been collecting more coins over the past few months.

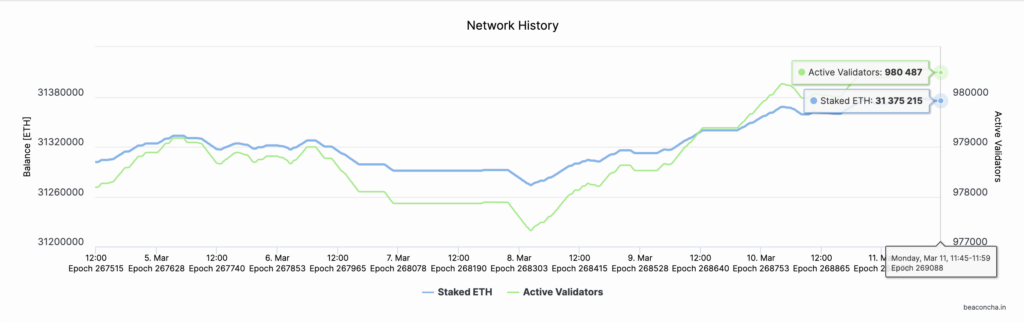

Ethereum node validaters have increased their bullish positions by depositing 2.4m ETH, worth $9.7bn, into beacon chain stake contracts since January 2024. Bitcoin miners, on the other hand, went on a selling spree of $21.5bn.

At the time of press on 11 March, the total staking deposit on the ETH 2.0 beacon chains stood at $1.4 Million ETH. That represents a 2.4 Million ($9.7 Billion) increase by 2024.

Ethereum node validators, unlike Bitcoin miners continue to increase their long-term bullish position as ETH prices rise above $4,000 per coin. Dencun speculations are positive upgradeThe bullish attitude of ETH investors is largely influenced by the progress made in filing ETH ETFs.

As long as these catalysts are still active, ETH may see even more coins removed from circulation. BTC supply will increase as miners put on increased selling pressure as the halving approach.

VanEck’s head of digital assets to Cryptoquant echoed this position in a recent Cryptoquant interview.

“Over the long term, ETH tends outperform BTC during the halving-year, right?” Don’t lose sight of the forest. I don’t believe there will be any flipping, but when 2024 is over, I think ETH will outperform BTC.

If the scenarios are as expected, ETH will probably extend its lead on BTC over the coming weeks.

- Technical Indicators Point to Ethereum’s Path towards $5,000

Ethereum will be expected to have a greater demand from the retail market than Bitcoin. It is also likely to experience a temporary drop in supply due to the increase of staking. These factors have put ETH on a path towards a new high above $5,000.

ETH currently trades above $4,030 at the time this article was written on March 11. The in/out-of-the money chart on IntoTheBlock shows that Ethereum is well on its way to a new record high.

Below, you can see that the chart shows the $4,500 area as the biggest resistance cluster over the current price. 617,760 accounts had purchased 1.6 million ETH in that range at an average price of $4,557.

Many of these holders may decide to close their positions when Ethereum prices reach their break-even level.

If ETH prices can find a strong support above $4,500, they could reach a new record high.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

Source: crypto.news