Takeaways from the conference:

-

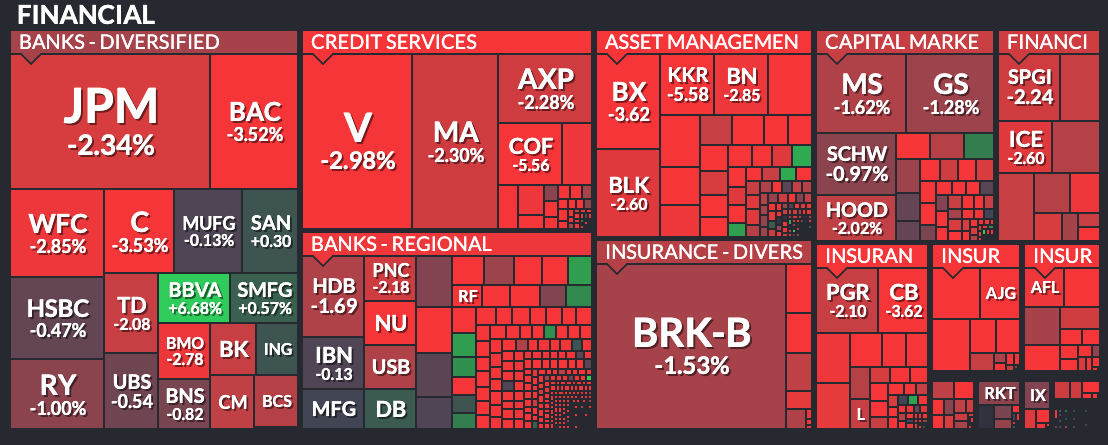

Financial stock prices fell as a result of the stress on US regional banks caused by auto industry bankruptcies.

-

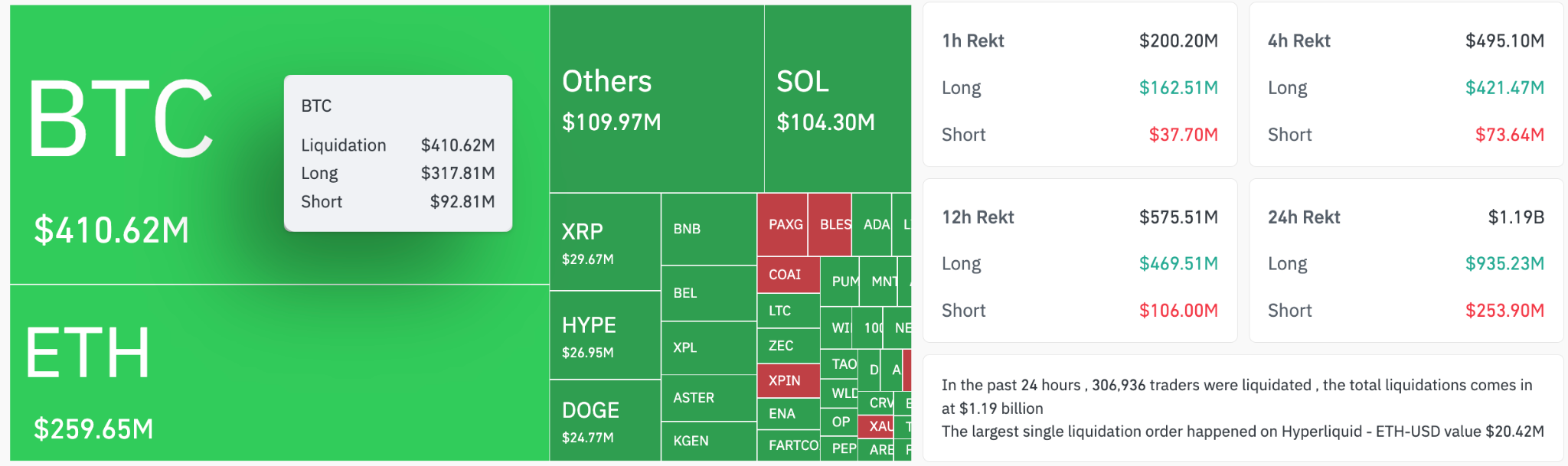

Bitcoin dropped below the 200 day SMA and fell to $104,500, amid $1.2 Billion in crypto liquidations.

-

Analysts see $88,000 as the second significant level of support for BTC if $104,000 doesn’t hold.

BitcoinBTCThe price of ) decreased to $104,000 on a black friday event for the second time as increased credit pressure among US regional bankers sparked a new wave of risk-aversion in the crypto markets.

Bitcoin extends losses as equities slide

Bitcoin prices began falling during New York hours of trading on Thursday. Investors turned defensive as equities fell, bonds gained and bonds rose. gold reaching a fresh all-time high.

The move came as a result of concerns about a looming financial crisis in the US. Regional banks were under pressure because they had been exposed to the two auto-sector bankruptcies.

Related: Investors are getting better at spotting bad Bitcoin treasuries: David Bailey

In late September, First Brands Group filed bankruptcy. It is an Ohio auto parts company with liabilities of $10 billion. Tricolor Holdings was a subprime lender that had $1 billion worth of debt.

This failure exposed the risky practices of lending in particular on private credit markets. Fears about contagion were triggered by this.

Zions shares fell by 13% following the announcement that it will incur losses of $50,000,000 in the third-quarter on two loans issued from its California Division. Western Alliance shares fell by 11% as it filed a lawsuit against CantorGroup V, Inc. for fraud.

As a result, the S&P 500 dropped by 0.63% to close the day at 6,629.07 on Thursday, while the Nasdaq composite index declined by 107 points (-0.47%). Dow Jones lost 0.65% and closed Thursday’s trading at 45,952.24

According to data provided by CryptoMarketCap, this panic spread to the cryptomarket, driving Bitcoin down to $104,500 on an intraday basis. The total market capitalization of cryptos dropped 5%, to $3.58 billion. Cointelegraph Markets Pro You can also find out more about the following: TradingView.

Bitcoin’s value plummets below $100,000

Bitcoin’s decline on Friday has extended its deviation from the Oct. 6, 2016 high. all-time high of $126,000 Liquidations on the derivatives’ market were massive, with a 16.5% drop.

Related: Bitcoin OG whales to blame for BTC’s painful rise: Willy Woo

Bitcoin accounted for 317,8 millions dollars of the $935.2 Million in liquidated long positions. Ether (also known as Ether) is a cryptocurrency.ETHLong liquidations accounted for $196.3 Million.

The figure shows that a total amount of 1,19 billion dollars was lost on both short and long trades.

“Another day with a lot of liquidations across the board. It’s not even just longs while the market has been going down,” said trader Daan Crypto Trades on Friday, adding:

“This is exactly what happens after most big flushes. Traders chop themselves up while trying to make back what’s lost.”

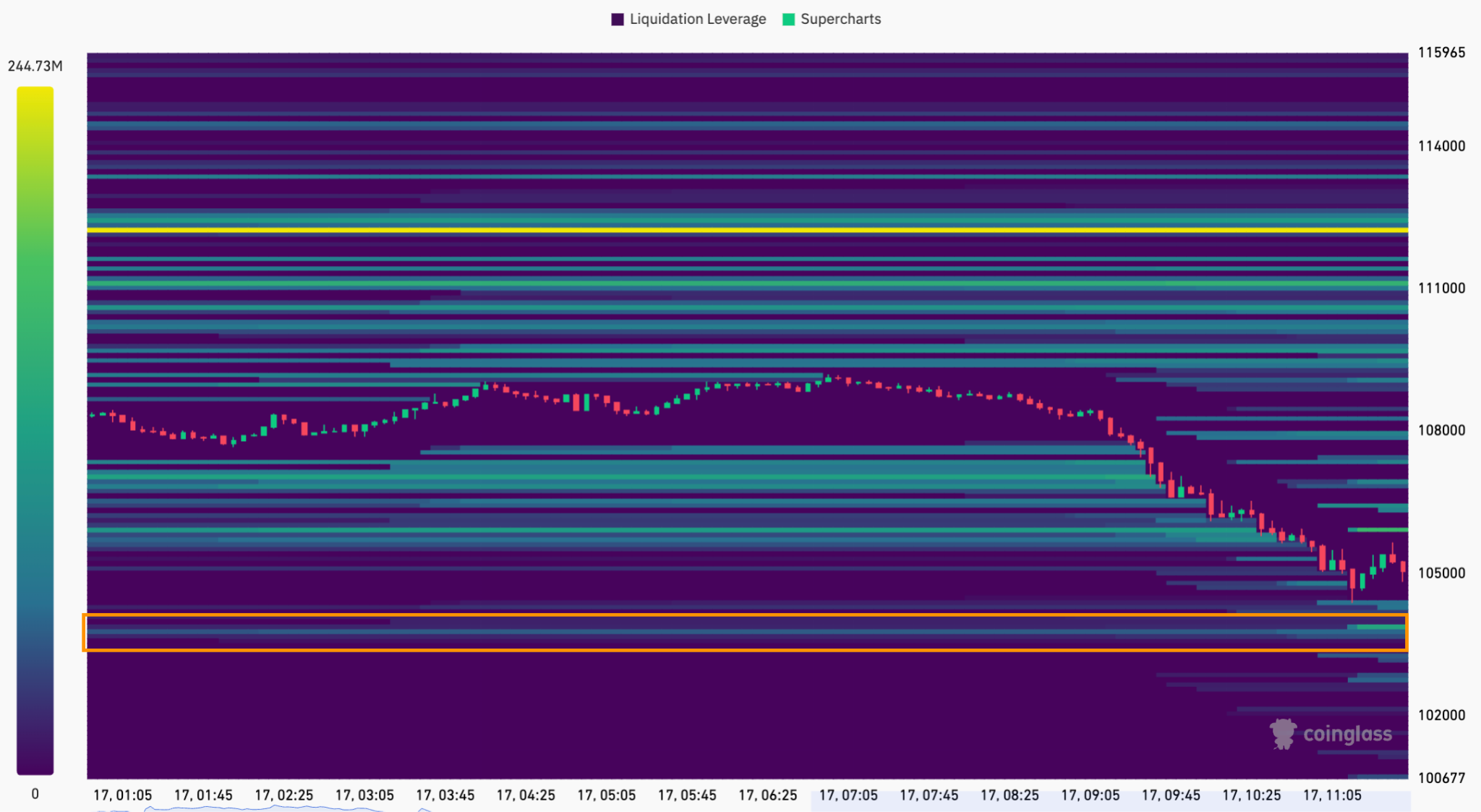

As shown below, CoinGlass data also shows the Bitcoin price consuming liquidity in excess of $105,000.

It is possible that Bitcoin will drop even further in order to wipe out the liquid within this price range, before staging a sustainable recovery.

What is the lowest price Bitcoin can go?

Bitcoin’s drop below $105,000 On Friday, it lost key areas of support, such as the 200-day SMA, which was $107,520.

The traders are now speculating on how low BTC will fall before finding its feet.

“No reversal in sight at the moment for $BTC,” The analyst Block_Diversity In an X-post.

A chart accompanied the article, showing key levels for traders to monitor on the daily charts, such as the last Friday low at Binance of around $101,000. Also, the areas where demand is highest are around $95,000, $88,000, and even the previous week’s lowest level.

“These are open targets, unless $BTCstarts getting support at $107.4K.”

“$104K is the HTF level that matters most right here,” said Sykodelic added, “We expect that the area will hold because the daily RSI now is at its lowest since the bottom of $74,000.”

“The weekly close this week will be very important.”

The following are some of the ways to get in touch with us. Cointelegraph reported, with the crypto Fear & Greed Index at yearly lows and at “extreme fear,” BTC’s price could rebound from the current levels in the very near future.

The article is not intended to provide investment advice. Each investment or trading decision involves some risk. Readers should do their own research before making any decisions.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com