Important points

-

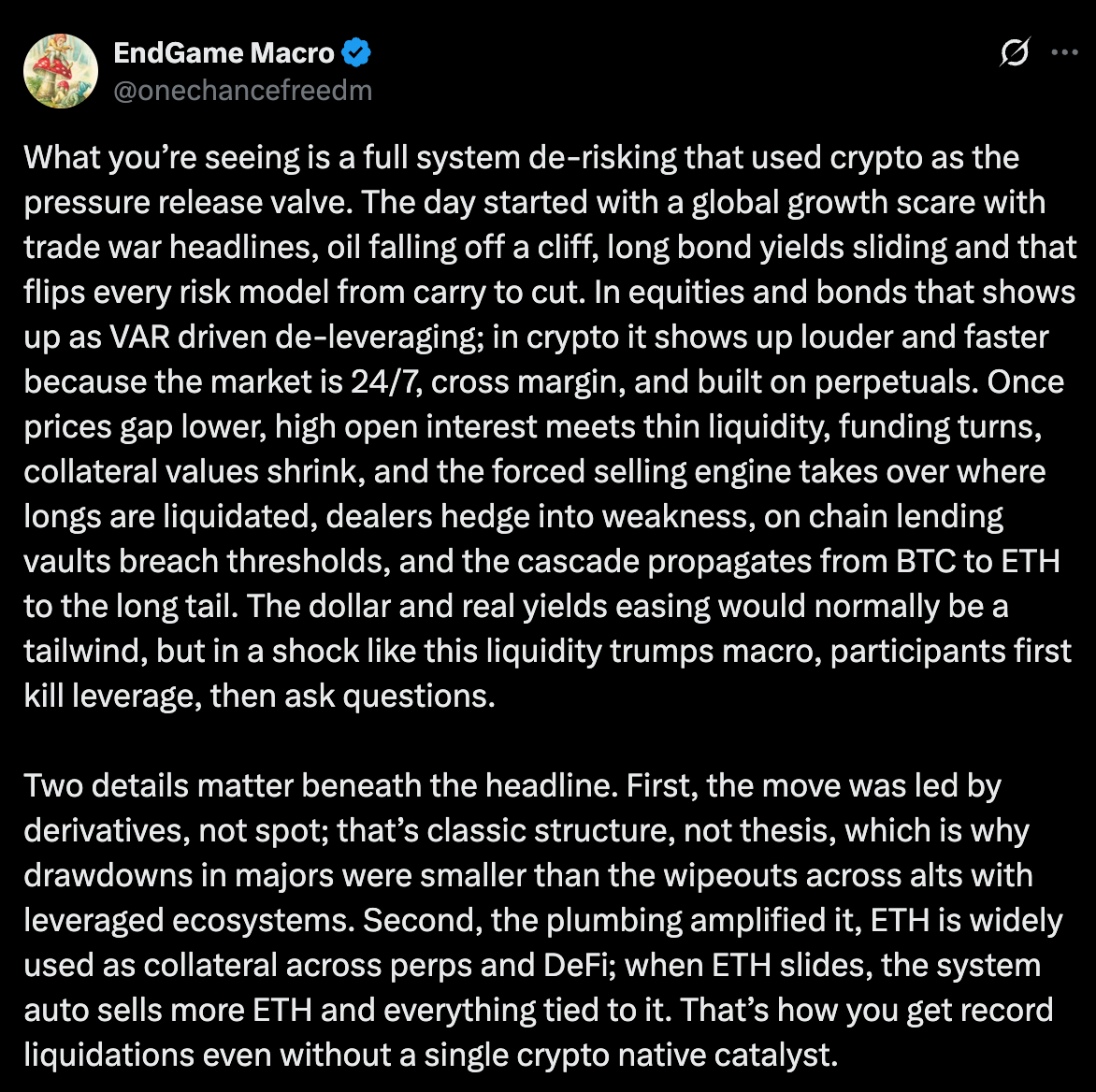

This sharp decline in open interest underscores the magnitude of the leveraged liquidityations, which totaled $20 billion. The traders are reluctant to enter the market again.

-

It is expected that the price and volume of bitcoin sales will continue to decline until CME BTC opens on Sunday night, US time.

Crypto market still reeling from historic Friday sell-off that resulted over 20 billion dollars in liquidations of centralized exchanges, and several hundred millions in the DeFi marketplace.

Crypto traders were caught by surprise when President Trump announced a tariff of 100% on Chinese imports Truth Social Post. CoinGlass data shows the extent of the flash crash. Bitcoin was down by about 5% at the moment of this writing.BTCEther () is a popular major that struggles to reach the $110,000 mark.ETHSOL) (SOLThe % and %) are both down by 3.74% & 7.0%, respectively.

Trump’s perfectly timed tweet Friday occurred in the final 2 hours of trading for both regulated cryptocurrency trading and equity trading. There is therefore a possibility for prices to continue falling as CeFi volumes and CEX orderbooks thin over the weekend.

You can also contact us by clicking here. speaking to Schwab Network Cointelegraph Head of Markets Ray Salmond and Nicole Petallides discussed how Bitcoin, Ether (and several other altcoins) were ready for use based upon data on liquidation heatmaps.

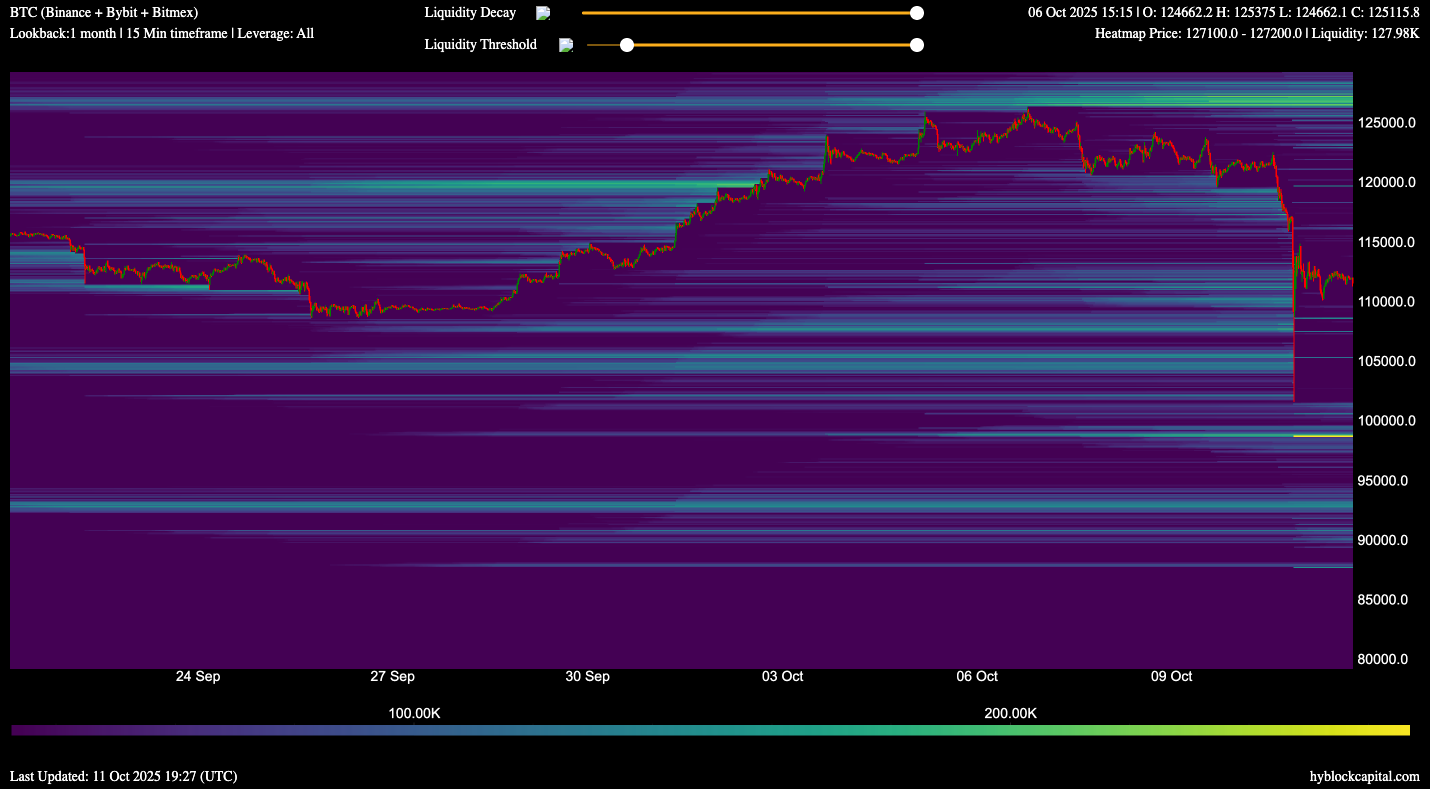

“If we look at liquidation heatmap data from Hyblock Capital, which basically shows where all the short and long positions are across various orderbooks at centralized crypto exchanges, we can see that there’s a liquidity pocket of long positions that are being exploited…that pocket extends from $120,000 to $115,000 and from $115,000 to $113,000.”

Salmond Added:

“There are plenty of metrics and data that suggest Bitcoin is trading at a discount right now. If you consider the mean price to be $120,000, a 1 standard deviation move away from that is $115,000, a 2 standard deviation move away from the mean is $110,000. Aggregate orderbook data for Bitcoin currently shows a sufficiently hefty amount of bids in that range.”

Related: Bitcoin may get ‘dragged around a bit’ amid Trump tariff fears: Exec

The liquidation heatmap is showing a small pocket of leveraged short positions around $98,600. BTC open interests highlights traders’ current hesitation to open new positions.

The chart below shows that global open interest (excluding BTC, ETH and other cryptocurrencies) has also taken a hit, with OI on most exchanges dropping by nearly 45%.

It is likely that Bitcoin will remain weak over the weekend and until the CME Futures Markets for Bitcoin and Equities open Sunday evening. It is possible that the nature of futures opening will provide traders insight into TradFi’s trading style. “feels” The current state of affairs

The market’s future direction will be determined by the global interest or uptick in the crypto markets.

Endgame Macro, X User provided One of the most comprehensive contextual analyses of what happened in the background before the crypto market chaos.

The article is not intended to provide investment advice. Risk is inherent in every investment decision and trade. The reader should always do research prior to making their final choice.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com