The key takeaways:

-

Wall Street’s Bitcoin year-end forecasts range between $133,000 and as high as $200,00.

-

Many agree that Bitcoin ETFs inflows, and the gold correlation could propel BTC to record heights.

BitcoinBTC() is gaining momentum and has risen by more than 13% over the last seven days. It’s now on its way to hitting a record of $124,500.

According to leading Wall Street financial institutions and UK financial institutions, Bitcoin will reach record highs by 2025.

Citigroup believes BTC will reach $133,000

Citigroup expects Bitcoin could end up at $133,000 by 2025, a new high. It implies a modest increase of 8.75% from the current levels, which are around $122,350.

In its base case, the banking giant projects a steady increase in revenue. robust inflows from spot exchange-traded funds (ETFs) You can also find out more about the following: digital asset treasury allocationsIt sees these as key drivers for Bitcoin’s next upward leg.

All US Bitcoin ETFs managed over $163.50 BTC as of Saturday. Citi predicts that new ETF flows will total $7.5 billion before the end of this year, which is expected to help sustain demand.

Citi’s bear case, on the other hand, places Bitcoin’s value as low at $83,000 in the event that recessionary pressures increase and risk sentiment declines.

JPMorgan Analysts: Bitcoin up to $165,000 in 2020

When adjusted for volatility Bitcoin is still undervalued compared to gold. according A team of JPMorgan Chase strategists, led by the managing director Nikolaos Pantigirtzoglou.

They wrote that the Bitcoin to gold volatility ratio is now below 2, meaning Bitcoin has about 1,85 times as much risk capital as gold.

According to this ratio, Bitcoin’s $2.3 trillion current market capitalization needs to increase by approximately 42%. This would imply a BTC theoretical price of about $165,000 to match the estimated 6 trillion dollars in private gold held across ETFs and bars.

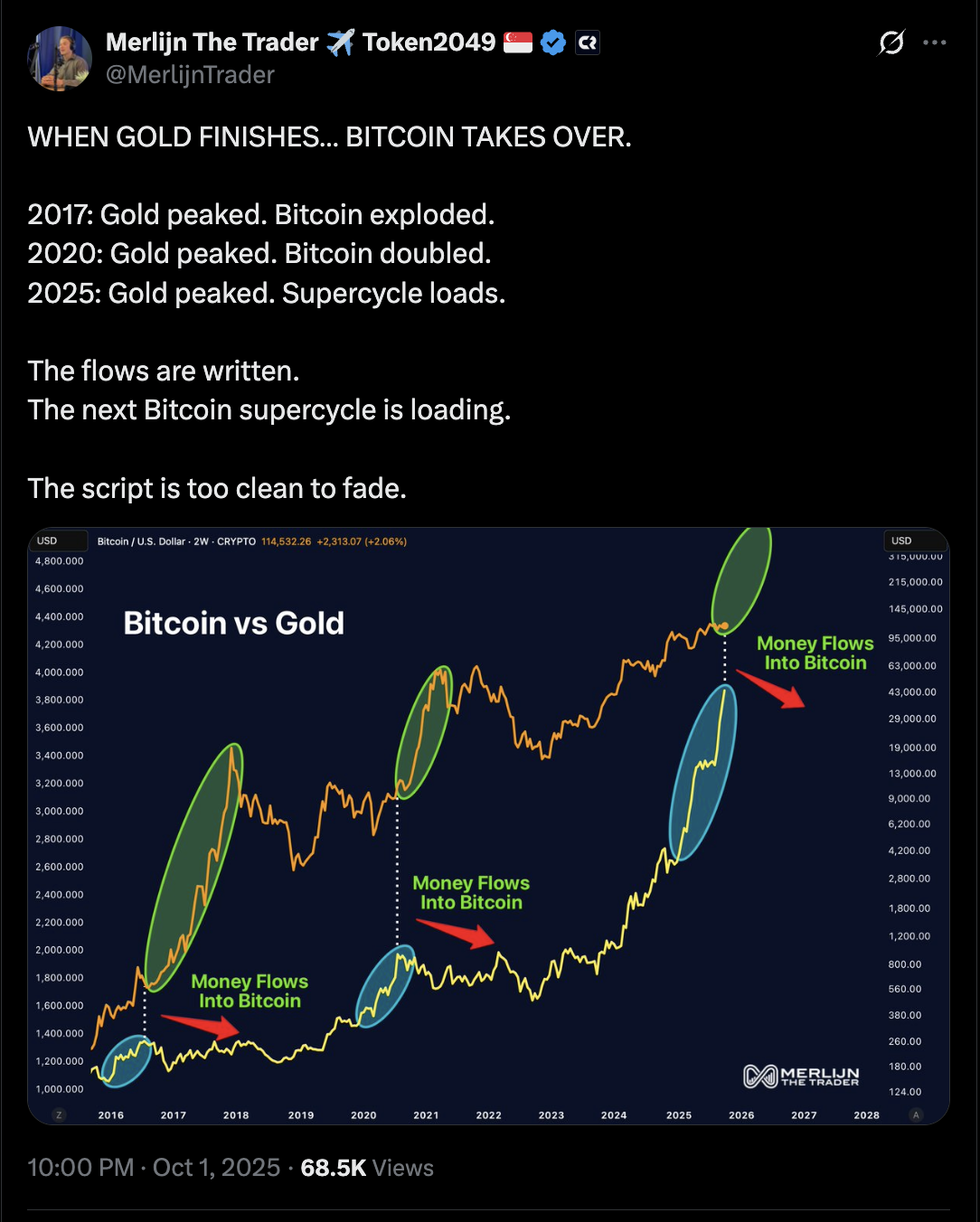

Gold can be viewed in many ways. Bitcoin’s traditional macro counterpartIt is on pace to achieve its best-ever annual performance.

The annual relative strength index (RSI) For the XAU/USD, it has climbed up to almost 89. Its most overbought value since 2012.

This is a level that historically preceded deep, multiyear corrections of 40–60%. Gold’s upward trend may slow down in the next weeks.

Related: Bitcoin’s rare September gains defy history: Data predicts 50% Q4 rally to $170K

Meanwhile, BTC has shown an 8-week lagging correlation with gold JPMorgan’s forecast for an end-of-year Bitcoin rally is further reinforced by the fact that capital has been moving away from gold in recent years.

JPMorgan’s bullish forecast also assumes that spot ETFs will continue to receive steady inflows. Federal Reserve continues its rate-cutting cycle The next months will be very busy.

Standard Chartered takes the lead with a bold $200 000 call

Standard Chartered is the most confident amongst major banks in predicting Bitcoin could reach $200,000 by December.

Like Citigroup and JPMorgan, the bank’s analysts cite sustained ETF inflows—averaging over $500 million per week—as a key driver that could lift Bitcoin’s total market capitalization closer to $4 trillion.

Growing institutional adoptionAlongside a weakening US Dollar and an improving global liquidity conditions, could set the stage for another parabolic move similar to Bitcoin’s 2020–2021 bull run, the analysts explain.

Standard Chartered’s analysts present the $200,000 situation as a “structural uptrend” It is more than just a short-term rally.

VanEck predicts Bitcoin to reach $180,000 by 2025

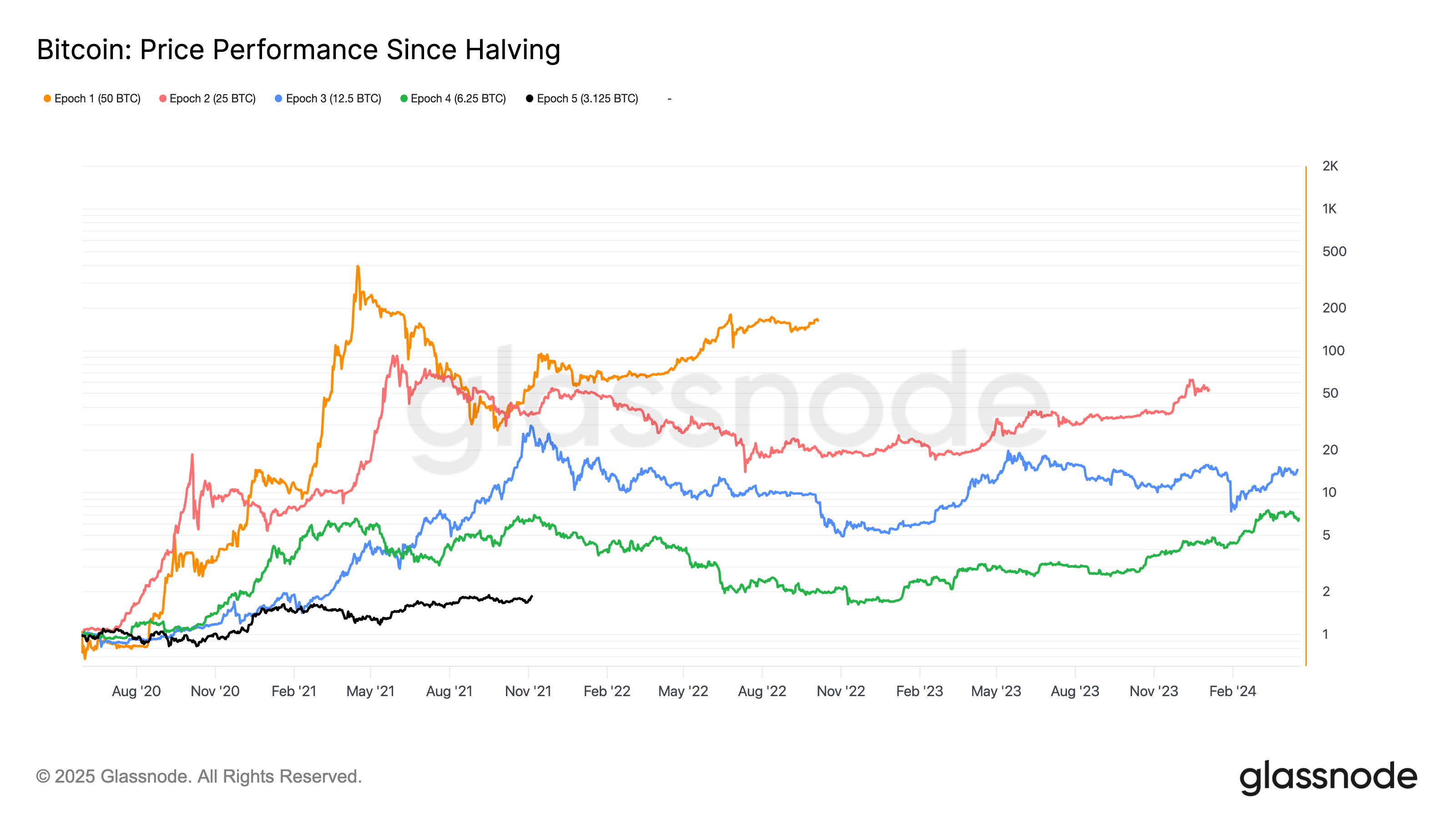

Asset manager VanEck projects Bitcoin may reach $180,000 in 2025 due to post-halving dynamics.

The firm claims that the April 2024 halving This has created the conditions for an increase in demand, and ETFs as well as digital assets are the fuel that will drive the trend upwards.

As shown below, Bitcoin’s recent performance mirrors previous cycles of four years.

Bitcoin cycle peaks have historically occurred between 365-550 days after the halving. Since the halving on Saturday, 533 days have passed. That puts Bitcoin firmly in the window historically for major rallies.

Saad Ahmed is the head of Gemini APAC. told Cointelegraph Bitcoin’s four-year cycle is not the only way that it could be extended. “driven more by human emotion than pure math” You will. “very likely continue in some form” into 2026.

This article contains no investment recommendations or advice. Each investment or trading decision involves some risk. Readers should do their own research before making any decisions.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com