- In recent days, the bulls of Solana’s market have gained rapidly.

- Increased profit for holders could lead to a selling wave in the near future.

Solana [SOL] See it Total Value Locked (TVL) Even though it is about 40% below mid-February’s price, the market has reclaimed its previous levels. The bullish fundamentals and potential of the market were reflected in this. SOL Make more profits

The report highlighted that the NVT tokens were overvalued.

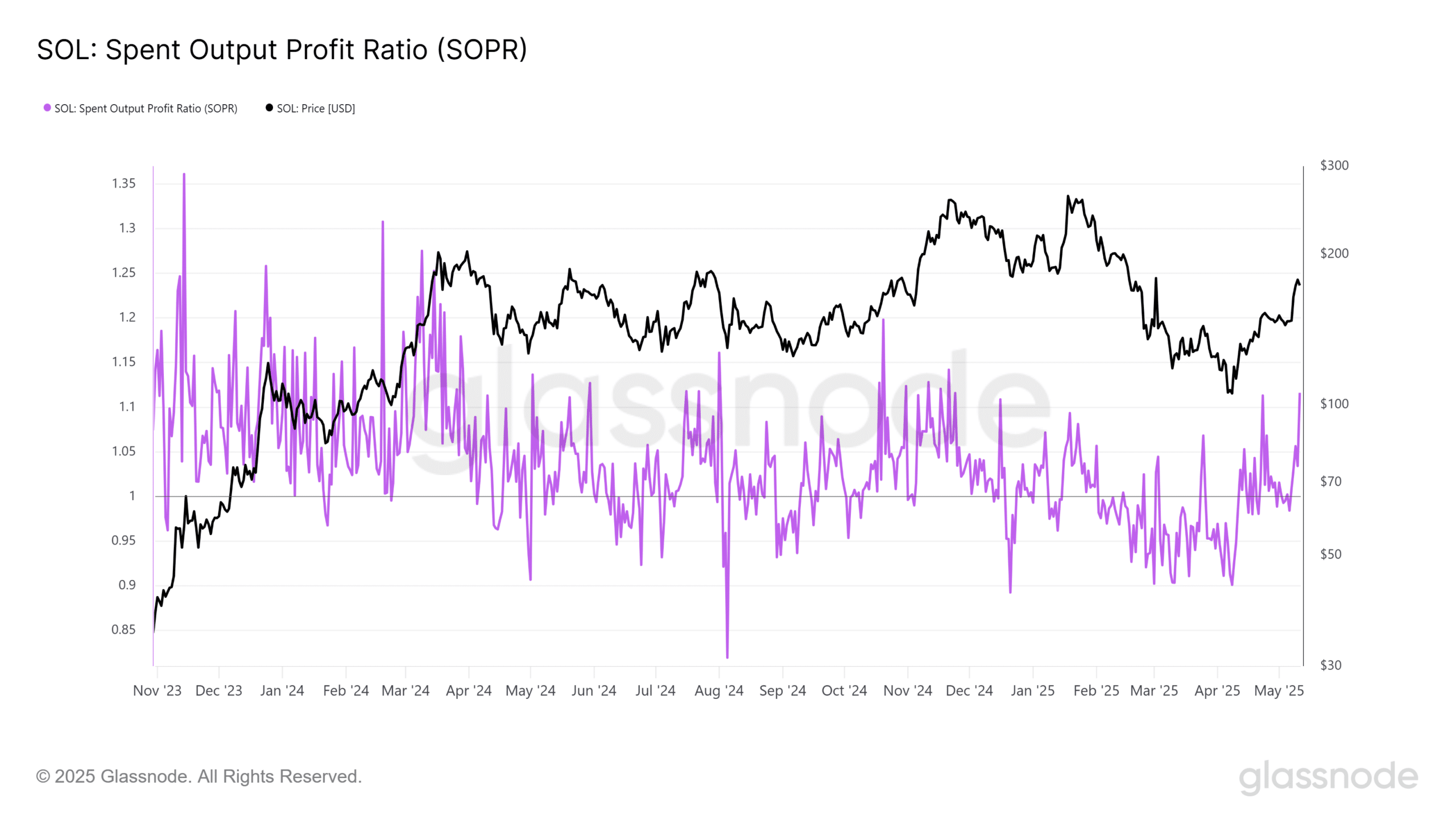

Source: Glassnode

In spite of the enormous potential, the distribution of relative addresses did not reveal a significant accumulation. The Solana supply metric is used to track the amount of Solana in circulation within certain balance bands.

Holders of more than 100k SOL increased their SOL holdings significantly after the rally from November 2023 to March 2024, which took SOL to $160. Also, the wallets that have a balance of at least 1k SOL increased in value.

This wallet added heavily to the market after a major price move. It is a good indication that not all moves in prices are preceded by accumulating on the whole.

During the November 2023 price spike, some sellers were likely to be heavily insolvent market participants.

Solana’s bullish prospects are not affected by the absence of an addition to the band for balances above 100k. But the SOPR can serve as a caution to investors.

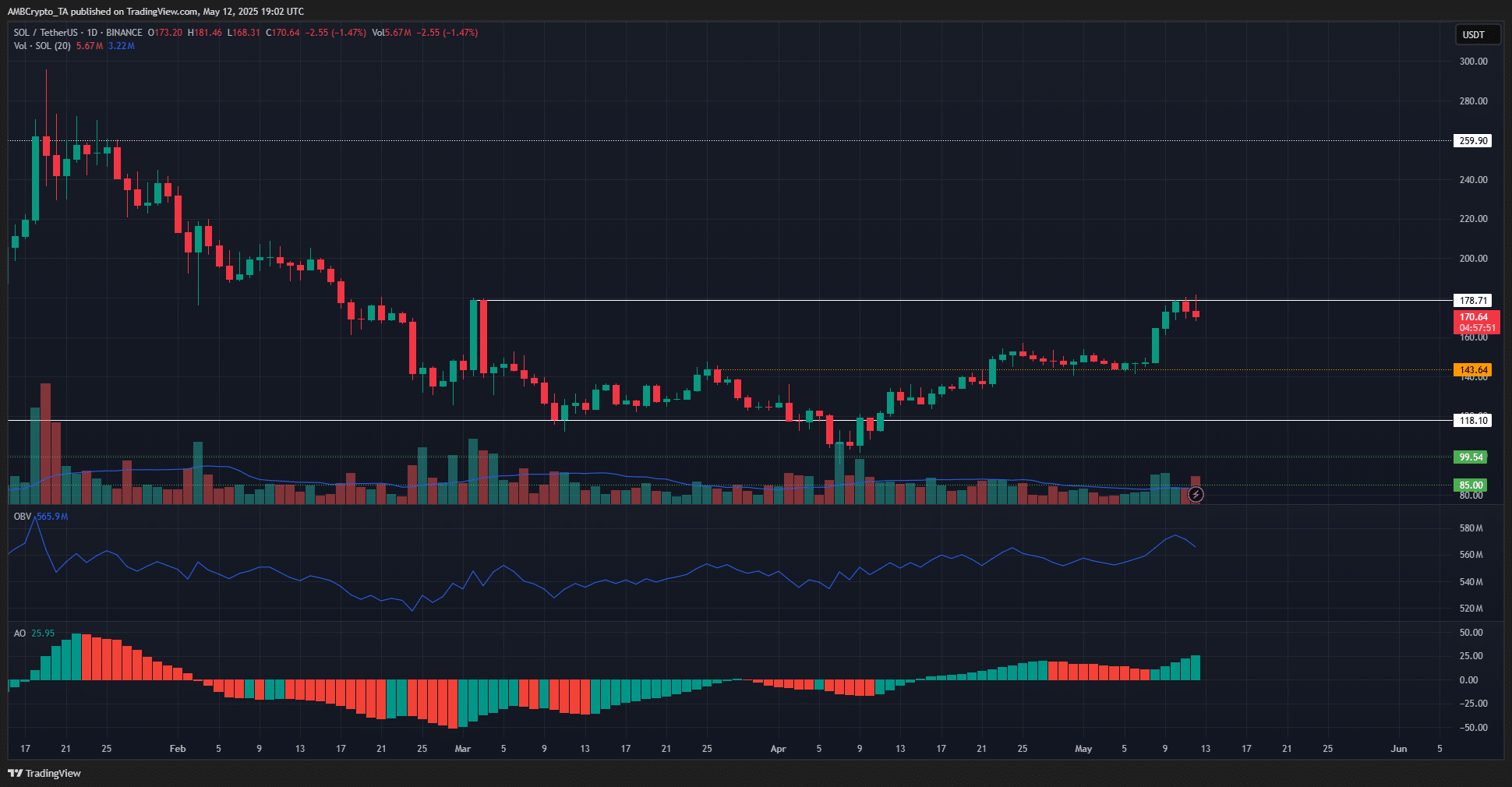

Solana challenges the $180 barrier once more

Source: Glassnode

The Spent Output Ratio (SOPR), at the time of publication, was 1,16. Price sold / price paid is a metric used to assess whether holder’s are making a loss or profit.

When the SOPR reaches the 1,06-1.1 value, Solana’s price has experienced a sharp retracement.

It is possible that a similar scenario could happen again. It was not only the pattern of past six-months that gave us the chance, but also a technical perspective.

Solana is showing a bullish chart structure on the one-day chart. The lower low of Q1 2025’s downtrend at $143 was beaten to restore a bullish bias. A week earlier, this level was used as a support before the move to $178.

The $180 area has, however, been a strong resistance since mid-February. Awesome Oscillator indicated a bullish trend, while the OBV was rising.

A price drop could happen if holders decide to take profits again. This is based on the values of SOPR. If the OBV continues to rise, investors can buy when prices dip below $150 or $160.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: ambcrypto.com