Bitcoin’s unintended benefit could be the United States’ push to adopt stablecoins in order to preserve the dollar’s dominance globally. Bitcoin is the largest cryptocurrency and it’s emerging as an asset that can potentially serve as a federal reserve.

US Treasury Secretary Scott Bessent stated that US government will Stablecoins can be used to guarantee that the US Dollar remains the global reserve currency throughout the White House Crypto Summit On March 7, 2019.

“We are going to put a lot of thought into the stablecoin regime, and as President Trump has directed, we are going to keep the US [dollar] the dominant reserve currency in the world, […]” Bessent said.

Bessent reaffirmed the Trump administration’s promise. end the war on crypto The Internal Revenue Service has committed to reversing previous guidance on regulatory penalties and other punitive measures.

Address by Donald Trump to White House Crypto Summit The Associated Press

Trump tweeted about the remarks just before he did. signed an executive order establishing Bitcoin)BTC( ) Reserve using cryptocurrency forfeited by government in criminal cases. The order, while not involving direct purchases of Bitcoin by the federal government, represents a change in the way the government looks at BTC.

Omri Hansover, general manager of Gems Trade Blockchain launchpad, says that BTC could benefit from stablecoin adoption, and the push for greater regulatory clarity.

“If Trump’s policy strengthens US financial dominance, Europe’s reluctance and ‘wait-and-see’ approach could weaken its economic leverage,” “I told Cointelegraph he added”

“This divide creates two market realities: US accelerates Bitcoin’s institutional adoption, drawing capital; and EU prioritizes compliance, risking a capital shift to US markets.”

Two major bills are awaiting approval by Congress: The Stablecoin Bill and the Market Structure billThe aim of the initiative is to reduce the uncertainty surrounding the US Crypto industry.

Related: US Bitcoin reserve marks ‘real step’ toward global financial integration

Bitcoin investors may benefit from the growing profits of stablecoin issues.

Bitcoin could benefit from the increasing profits made by stablecoins, which would further strengthen its position as a value store.

Tether is the largest stablecoin in the world, Tether USDt.USDTIt said it would diversify its assets by investing 15% of net profits into Bitcoin.

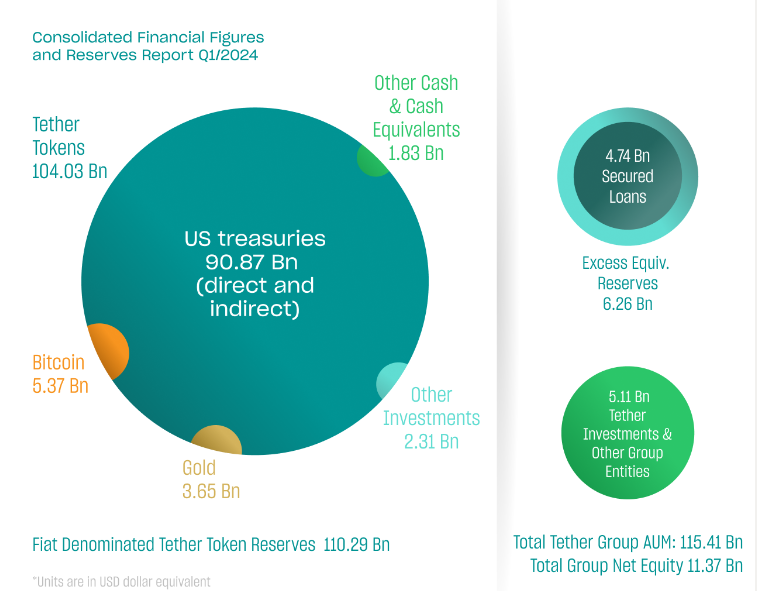

Tether’s Bitcoin holdings proved to be profitable after the company posted a profit. record $4.5 billion profit For the first quarter 2024.

About $1 billion of the $3.52billion was derived by the company from its US Treasury positions. The remaining amount, however, came from the gains made on the Bitcoin and gold holdings.

Tether’s financial reserves for Q1 2020. Source: Source Tether

Related: Paolo Ardoino: Competitors and politicians intend to ‘kill Tether’

Tether’s “bc1q” Address currently has over $6.8 Billion worth of Bitcoins, which makes it the sixth largest Bitcoin holder in the world. BitInfoCharts Data shows

Tether’s Bitcoin holdings Cointelegraph, a Cointelegraph report from Jan. 31, reported that the company earned $5 billion of profits in 2024.

Magazine: Bitcoin’s odds of June highs, SOL’s $485M outflows, and more: Hodler’s Digest, March 2 – 8

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com