Bitcoin breaks records with a BTC price increase of almost $82,000 for the first week.

- Bitcoin traders believe that the BTC price will continue to rise despite fears of a steep retracement.

- As the United States Presidential election fever fades, macroeconomic data continues to be released in a frenzy.

- Bitcoin traders finally see BTC/USD catch-up with gold after months of frustration.

- BTC gains in price may be spectacular, but it’s a ways off before they match the historical average.

- Mainstream interest is picking up, but just like in Bitcoin’s last halving year, all-time highs have not opened the floodgates to mass retail inflows — yet.

Bitcoin traders disagree on future BTC prices

Bitcoin) has reached a high of almost $82,000.BTCThe price of BTC is rising as the week begins.

The Data of Cointelegraph Markets Pro The following are some examples of how to get started: TradingView Bitstamp hit a new high of $81,888 after the close.

BTC/USD 1-hour chart. TradingView

Many people are afraid of the effects that climate change will have on their lives. major retracement A general sense of optimism remained the main driving force for traders.

“Passive sellers still pretty active around $81.5K. Alts lacking bid momentum so far as well,” Trader Skew wrote In one of his recent posts, X.

Skew said that the beginning of TradFi’s trading week would help bulls, possibly validating their cause. “out-of-hours” Weekend jump to new heights

“Bids moving higher again but still lacking the volume & momentum like previous moves up,” He said about exchange order book liquidity.

“Probably coiling into EU/US hours.”

BTC liquidation heatmap. Source: CoinGlass

The market is pointing out that a longer-term perspective could lead to even greater upside. BTC/USD has seen a seven-month phase of consolidation since March, when it hit its previous all-time-high.

“Bitcoin gave everyone a chance to buy breaks from Mar-Oct ’24,” Peter Brandt is a well-known veteran trader said Over the weekend

“When BTC decides to ‘Mark-Up,’ it never looks back.”

BTC/USD one-day chart. Source: Peter Brandt/X

Brandt set a price goal of $125,000 for BTC by the end the year. previously seen $130,000 Only in the third quarter of 2025.

This week’s close will be on Sunday. satisfied conditions Bitcoins are now entering the market “parabolic phase” Its current bull run.

CPI Week takes the place of US Election fever

US macroeconomic data is likely to keep traders of risk assets on their toes over the next couple days. Federal Reserve’s financial policy will also be nuanced.

Both the Consumer Price Index and Producer Price Index, both important inflation indicators, will be published in October.

When it comes to US inflation and the Fed, there are mixed messages. cut interest rates by 0.25% Last week, unemployment was low.

On Nov. 14 we will get more data on jobless claims, along with PPI as well as a speech from Fed chair Jerome Powell about the outlook for the economy.

“Markets will also continue to digest earnings season, the election outcome, and the Fed meeting,” Trading resource The Kobeissi Letter said What is called an a “very busy week.”

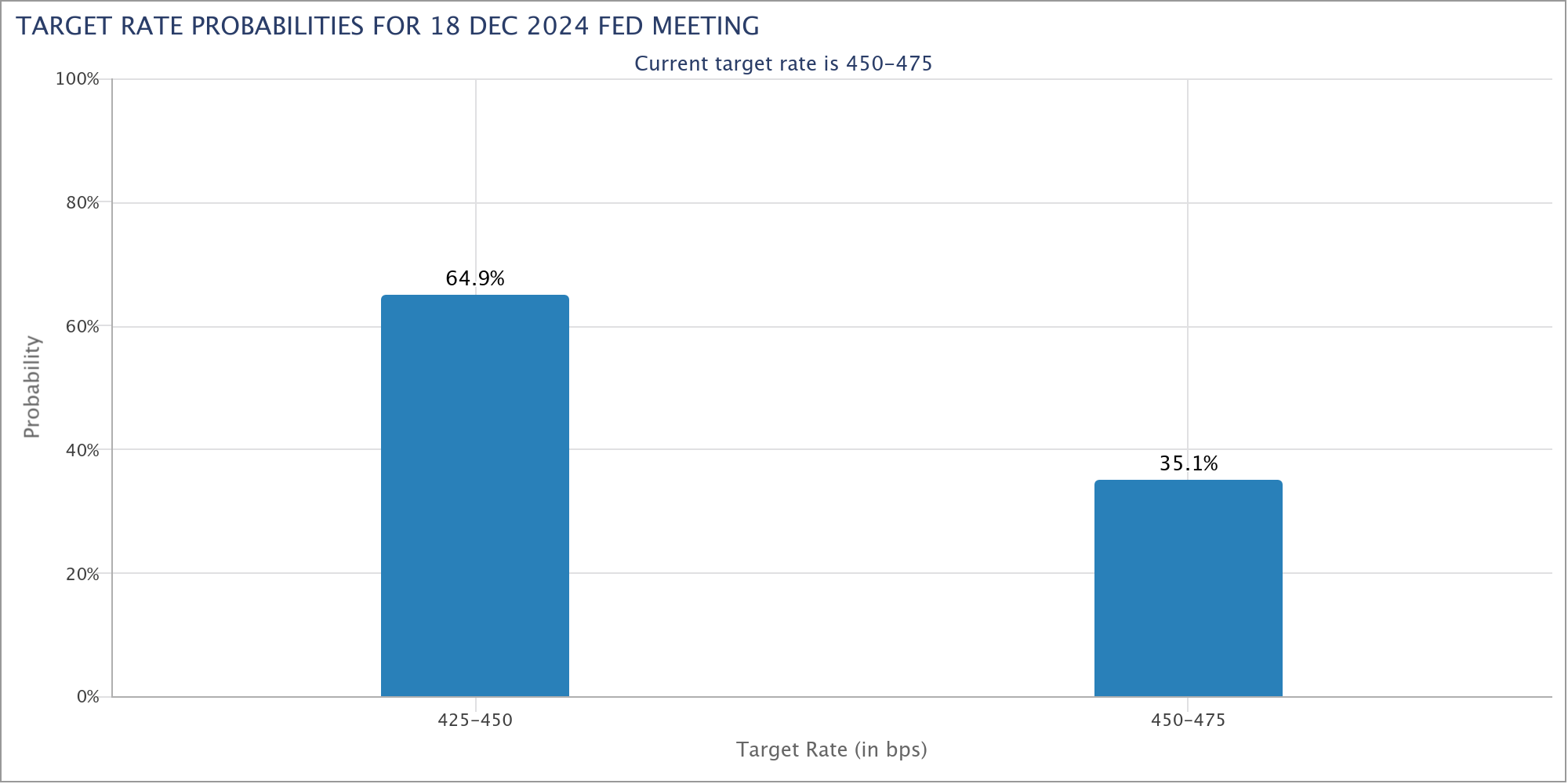

Fed Target Rate Probabilities Source: CME Group

CME Group: Latest data FedWatch Tool The Fed will likely cut rates by another 0.25 percent at its next meeting, which is scheduled for December 18.

“Overall, investor sentiment and risk appetite are historically strong right now,” Kobeissi continued In an X-thread on November 9.

“As we head into 2025, it’s clear that the economy is slowing and fiscal policy is uncertain.”

The following are some of the ways to get in touch with us. added that despite the S&P 500 notching its own record highs of 6,000 points last week, such strong performance is “never sustainable,” Gains of almost 50% in the past year.

Bitcoin competes with gold

Longtime crypto market participants now see Bitcoin attempting to play a game of catch-up — not with stocks, but with gold.

XAU/USD was started rising in advance Bitcoin is still below its previous highs in March, while BTC/USD remains at a low level.

Charles Edwards, the founder of Capriole Investments (a quantitative Bitcoin fund and digital assets fund), uploaded to X a comparison chart on November 11, and saw that bulls were now quickly redressing any imbalance.

“Here we go. Shared this chart a few times – Bitcoin lags Gold a few months,” He told followers.

“When the breakout happens, expect rapid repricing.”

Bitcoin chart versus gold. Charles Edwards/X

The BTC price break is being supported by an institutional investment milestone. Inflows into BlackRock’s Bitcoin spot exchange-traded funds (ETFs) were seen last week. surpassed those of its gold ETF.

The gold ETF, as noted by commentators, has been in the market for about 20 more years.

Source: Bitcoin for Freedom

QCP Capital, a trading firm, suggested last week that Bitcoin ETF inflows combined with spot price performances could end up creating a “snowball” effect.

“This sustained bullishness in BTC could also create a feedback loop, with rising ETF inflows boosting BTC prices, which, in turn, attracts more retail capital and systematic fund buying as volatility declines,” It told Telegram subscribers.

What makes November different?

Bitcoin’s monthly performance is not unusual in November of 2024. It stands at about 16 percent.

BTC/USD is still a ways off from making this November special, despite its repeated all-time highest levels throughout the month.

BTC/USD Monthly Returns (screenshot) CoinGlass

Data collected from Monitoring Resource CoinGlass puts the situation in context — for instance, November 2020, Bitcoin’s last halving year, saw gains of 43%.

2017 was also the same year that Bitcoin reached its all-time highest in November, but 2013 had a 450% return on the month. Bitcoin lost 37% in November 2018, its lowest level since 2011.

There are so many variations. “average” The November return is about 43 percent, which has led traders who are already bullish to predict more gains before the month’s close.

“$BTC next area of interest is $93k before pullback and consolidation and then $121k to complete the wave (5),” One such approach was taken by trader Mikybull Crypto who used Fibonacci levels. said 11 November

BTC/USD one-week chart. Mikybull Crypto/X

As the date for this historic event changes, it is becoming more common to predict BTC prices in six-figures. As Cointelegraph reportedThis is the most popular timeframe.

Karan Singh Arora is a crypto educator. described $100 as a “inevitable” By the end of this year.

“$100k $BTC is less than $20k away,” Johnny, another trader noted.

“Kinda crazy how far we’ve come.”

The mainstream mood is echoed by the 2020 BTC price breakout

The appetite of mainstream consumers for Bitcoin remains absent, excluding institutions.

Related: Bitcoin’s rise to $81,000 may trigger rally in ETH, SOL, SUI, AAVE

Latest data on Google Trends As in 2020 consumers will only begin to pay attention when BTC prices start rising.

“Recent spike up but still early,” Bitcoindata21: Analytics account summarized X.

“For comparison December 2020 (price discovery above $20k) closed at 35, so quite similar.”

Worldwide Google search data for “Bitcoin” (screenshot). Google Trends

Previously, Cointelegraph reported There are several ways to gauge the bull market in Bitcoins based upon mainstream engagement. None has so far reached “classic” Top territory is blown off.

Apple’s AppStore does not rank the Coinbase app as the most popular trading application.

“Starting to move up now, as well as Robinhood, but let’s see if this move up is sustained. The app reached No.1 in December 2017, April 2021, and November 2021,” Bitcoindata21 noted.

This article contains no investment recommendations or advice. Each investment or trading decision involves some risk. Readers should do their own research before making any decisions.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com