- The price of ADA has increased by more than 60% over the past seven days.

- Indicators on the market suggested that prices would be corrected soon.

Cardano [ADA] The last few days have seen a remarkable performance. ADA’s most recent data indicated a pullback. Cardano’s bull market is over.

Cardano prices increase dramatically

CoinMarketCap’s data Last week’s price increase of more than 60 percent for the token was a clear indication that ADA bulls had outdone the bears. Price of the token has increased more than 36% just in the last day.

Cardano’s latest trend has brought profits to investors who had mostly lost money.

Over 52% of all ADAs were profiting from the recent uptrend.

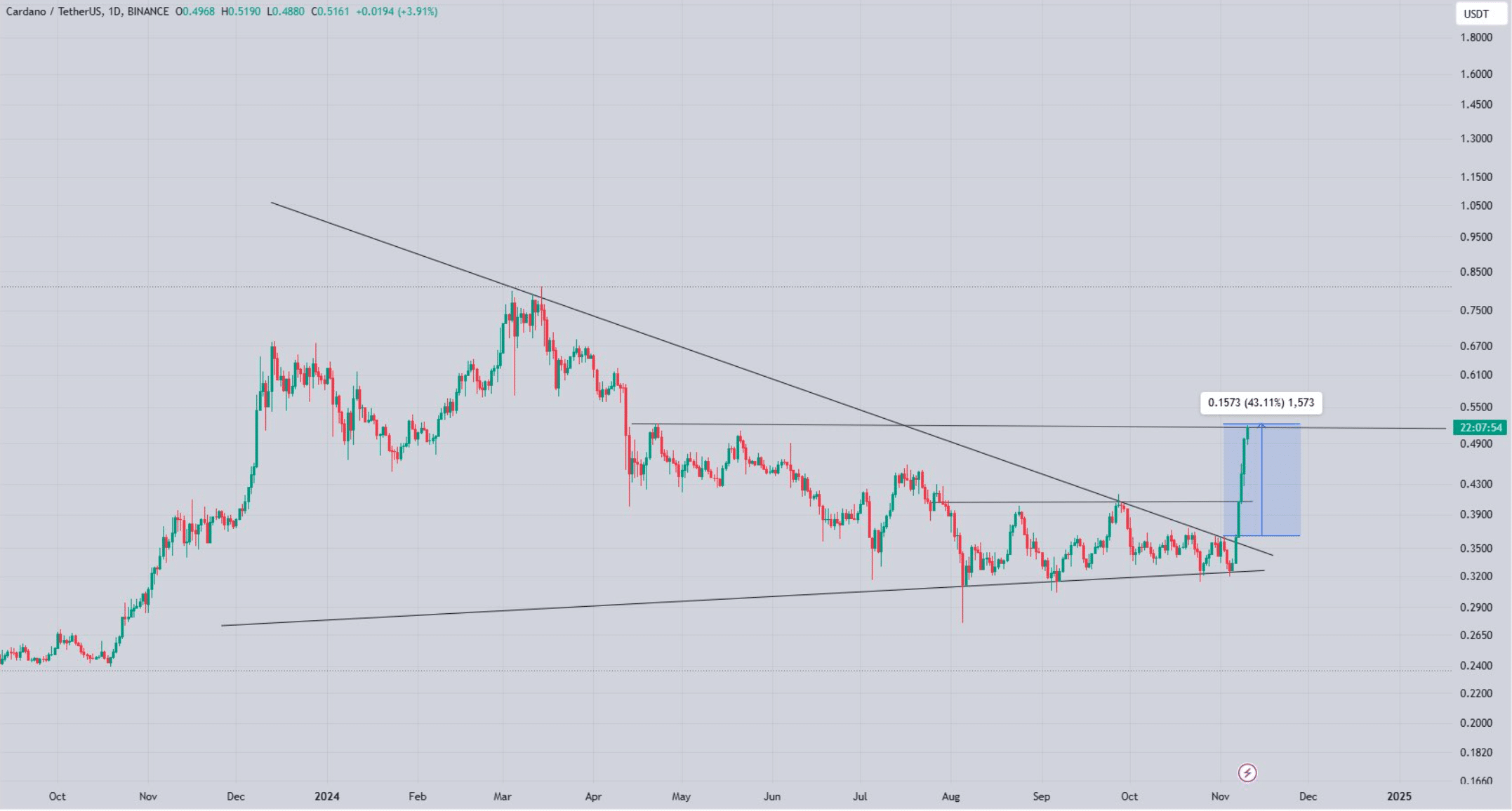

World of Chats a popular Crypto analyst recently posted an article. tweet ADA achieved a successful break-out after an emergence bullish breakout.

Cardano has been consolidating its price within the pattern since December 2023.

ADA is up over 40% since the breakout.

AMBCrypto checked a number of other datasets in order to determine whether the bullish trend would continue, since some metrics looked negative.

When will the bull run of ADA end?

Coinglass: Our Analysis data Cardano’s long/short ratio has declined in the last day.

It is clear that the number of short positions on the market has increased. This can be interpreted as a negative development.

To better understand Cardano, we then looked at Santiment’s data. According to our analysis of Santiment’s data, Cardano’s number of daily active addresses has dropped over the past few days.

The rest of the metrics look pretty good.

To illustrate, the trading volume for a token rose along with its cost. The trading volume increases along with the token’s price. This is a good foundation for bull rallies. The MVRV of the token also increased.

Cardano’s dominance in social media has also increased dramatically, indicating that its popularity has risen over the past few days.

Whether you think it’s realistic or not. ADA’s market cap in BTC terms

AMBCrypto looked at the daily chart of ADA, keeping these things in mind. The token price was way over the Bollinger Bands upper limit.

It means the odds of a correction in price are very high. RSI (Relative Strength Index) also fell into the zone of overbought, which can trigger a fall in prices.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: ambcrypto.com