Bitcoin is at a crossroads in the second half of March as new lows for multiple months are getting closer.

-

The analysts and traders are in agreement that not much stands between BTC/USD sealing its worst weekly candle ever, as it retests at $78,000.

-

CPI and PPI will be released as the markets move into a risk-off period and stock futures plummet.

-

Bitcoin: How Low Can It Go?BTC) go? They’re back to the old 69,000-dollar all-time highests in 2021.

-

The mood is not only in crypto but also among the general public. However, not all people believe that it is as bad they think.

-

The whales bought throughout the week. This indicates a good risk-return at current prices.

BTC price dives 14% in a week

Bitcoin’s weekly candle, which has just closed at $80,000, is a glaring example of the latest Bitcoin weekly candle.

BTC/USD lost more in value than ever before in US dollars in just seven days, according to data collected by Cointelegraph Markets Pro You can also find out more about the following: TradingView shows.

BTC/USD 1-week chart. Source: Cointelegraph/TradingView

Bulls are avoiding a repeat of the multi-month lows that were reached in late February. However, among Bitcoin traders there is a cautious mood.

“Bitcoin is back in the critical zone of the weekly parabolic trend,” Kevin Svenson, an analyst at Kevin Svenson writes in his latest analysis On X.

“We are still holding the current lows of last week, no new low has been created yet. This is $BTC’s last chance to maintain an exponential higher low.”

BTC/USD chart for 1 week with parabolic trendline. Source: Kevin Svenson/X

The Trader SuperBro has joined the preparations for an upcoming rematch of $78,000.

“Closed above the prior candle’s low and 50% level, but cracked the uptrend from Oct ’23,” A reaction Weekly close is indicated.

“A candle like that rarely turns on a dime, so despite bullish divergences on the LTF I’m prepared for a sweep of the lows.”

BTC/USD 1-week chart. Source: SuperBro/X

Some wanted more information to prove a true bearish collapse.

“Are we in a bear market now? Simply no. There isn’t enough confluence to confirm that at all,” CrypNuevo, a trader in the a dedicated X thread.

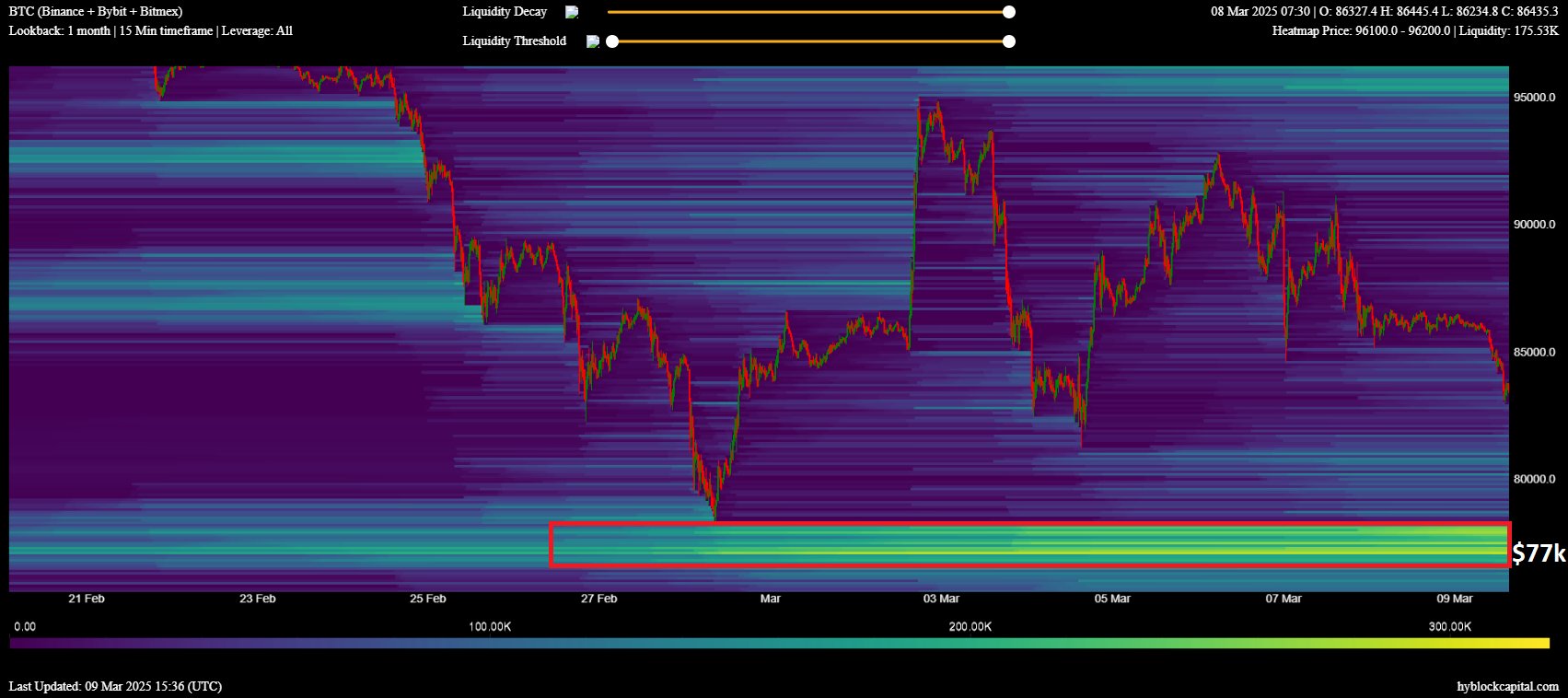

For him as well, new lows are on the way, and the $77,000 area is particularly crucial.

“We can see some liquidations exactly at $77k in HTF, although they are not as reliable as LTF liquidations,” He went on.

BTC order books liquidity data. Source: CrypNuevo/X

CPI is overshadowed this week by the market’s nerves

The US economic data released this week is not short, but the markets have already shifted to a more positive outlook. “risk-off” stance.

Both the Consumer Price Index and Producer Price Index are due in February, as well as the usual job openings figures and unemployment claims.

CPI as well as PPI overshot the mark Mark confidence was shaken by a rise in inflation last month.

Since then, crypto and stocks have not recovered, with next week’s Federal Reserve decision on interest rates showing little signs of optimism.

CME Group: Latest data FedWatch Tool Probabilities of a March 19 rate reduction are just 3%. The odds of a rate cut at the Fed meeting in May are rapidly decreasing.

Fed Target Rate Probability Comparison Source: CME Group

“Amid all the trade war chaos, we have seen economic growth expectations crash sharply,” The Kobeissi Message explains the trading resources in its entirety latest X analysis.

“The Atlanta Fed reduced their Q1 2025 GDP growth estimate to as low as -2.8% last week. As a result, we saw interest rate cut expectations move up SHARPLY last week.”

Kobeissi said that stocks are preparing for short-term gains. “red” open.

“Crypto’s decline was a clear indication of growing risk-off sentiment this weekend,” You can also find out more about us here. summarized.

BTC to return in 2021 at the current price?

Bulls are getting nervous as they look at the BTC bottom price targets.

With $80,000 hanging in the balance, one classic forecasting tool suggests that a reliable floor may only lie at an old Bitcoin all-time high — not from last year, but from 2021.

Created Lowest Price Forward, a tool developed by network economist Timothy Peterson for 2019, effectively sets BTC prices that won’t be breached in future.

By mid-2020 it will be a new era. correctly predicted BTC/USD wouldn’t trade under $10,000 after September.

The new line is somewhere between $69,000 and $79,000.

“Lowest Price Forward doesn’t tell you where Bitcoin will be. It tells you where Bitcoin won’t be,” Peterson told X number of followers on a new post made this month.

“There is a 95% chance it won’t fall below $69k.”

Bitcoin Price Chart for the Future. Source: Timothy Peterson/X

Peterson’s tool isn’t the only one aiming for new macro-lows in BTC/USD.

The following are some of the ways to get in touch with us. Cointelegraph reportedBitcoin’s moving average simple (SMA) of the past 50 weeks is a target that should be reached at $75 560.

This is the first instance since October that the 200-day SMA has failed as a line of support for the bullish market around the most recent weekly closing.

Source: Cointelegraph/TradingView. BTC/USD chart for 1 week with 200 and 50 day SMA. Source: Cointelegraph/TradingView

“An ugly start to the week,” Arthur Hayes is the former CEO of BitMEX. wrote in responseOpen interest (OI) is a term used to describe the openness of an individual’s mind.

“Looks like $BTC will retest $78k. If it fails, $75k is next in the crosshairs. There are a lot of options OI struck $70-$75k, if we get into that range it will be violent.”

This is the current low for the multimonth period. just above $78,000 The end of the month was February.

Bitcoin and macro sentiment are at historic lows

The current crypto-market sentiment, and Bitcoin in particular, is not a secret. However the level of bearishness that has been expressed may surprise some.

Latest data on the Crypto Fear & Greed Index Puts the mood back into the Gesamtstimmung “extreme fear” Last week, the market was only closed for a single day.

Index readings have never been so low in the last three years. Bitcoin’s surge to $78,000 monthly triggered a new record for a 3-year period of only 10/100.

Crypto Fear & Greed Index (screenshot). Source: Alternative.me

Not only crypto. Barchart’s finance and trade resource noted that stocks were also nervous to a degree not experienced in the past century.

“Sentiment is extremely bearish, which is actually bullish,” Peterson argued The same information is also available.

“Lowest reading since the bottom of GFC and COVID crash. Markets soared after that. Opportunities of the decade.”

Source: Barchart

Anthony Pompliano, CEO of Professional Capital Management and founder of the crypto investment firm Professional Capital Management, has called for investors to ignore sentiment indicators.

“The Fear & Greed Index for crypto one year ago was at ‘Extreme Greed’ of 92. Today we are at ‘Extreme Fear’ of 17. Bitcoin is 20% higher over the same time frame,” An X-post from March 10, reads.

“Don’t get tricked by online sentiment. It is all noise.”

Bitcoin Whales Wake Up

There is light at end of tunnel for what has now become a massive crypto bull market dropback.

Related: Bitcoin’s odds of June highs, SOL’s $485M outflows, and more: Hodler’s Digest, March 2 – 8

Santiment’s research shows that there are a few positive signs, and one of them stands out.

Bitcoin Whales were active in the first week of March. “sharks” — entities with 10 BTC or more — felt it appropriate to start increasing their BTC exposure again.

“In short, their mild dumping from mid-February to early March contributed to crypto’s latest dump,” Santiment writes in part X commentary.

“But since March 3, wallets with 10+ $BTC have accumulated nearly 5,000 Bitcoin back into their collective wallets.”

The Bitcoin shark is a cryptocurrency whale. Source: Santiment/X

The researchers acknowledged that prices have yet to reflect the conviction of their research, but that a delayed reaction could mean that a new relief rally is next.

“Prices have not reacted to their buying just yet, but don’t be surprised if the 2nd half of March turns out much better than the bloodbath we’ve seen since Bitcoin’s ATH 7 weeks ago… assuming these large key stakeholders continue their coin collecting,” The conclusion was that they were.

The article is not intended to provide investment advice. Each investment or trading decision involves some risk. Readers should do their own research before making any decisions.

“This article is not financial advice.”

“Always do your own research before making any type of investment.”

“ItsDailyCrypto is not responsible for any activities you perform outside ItsDailyCrypto.”

Source: cointelegraph.com